Index funds are not the Holy Grail of investing.

People also get wealthy from real estate, individual stocks, and crypto. Every asset class has its pros and cons.

Touting index funds as diversified can be misleading. Diversification doesn’t mean every stock in an index fund has the same weight.

I’m not saying you should dump your index funds and go all in on individual growth stocks. No. I’m saying index funds aren’t perfect.

And you should be aware of their risks.

It’s hard to argue with these benefits

There’s nothing wrong with investing in index funds if you have a multi-decade-long investment horizon.

Nobody has lost money from investing every month in the S&P 500 for twenty years. Why it works:

Management fees are tiny

Index funds are widely available

You can reinvest the dividends tax-free until withdrawal

Underperforming companies get kicked out of the index

You don’t have to fret over picking individual stocks in the fund

And the S&P 500 offers a degree of diversification because it contains 500 individual companies.

When people say “the market is going up,” they usually mean the S&P 500 is going up. And the phrase “average returns” has a negative connotation because it’s like being an average performer at your day job.

What “average” means for the S&P 500 is the returns of the 500 largest US companies. These are very good returns.

But there’s a caveat.

There’s a notion we need index funds

The financial industry heavily promotes index funds.

It uses mathematical models that project a 7% annual return over a long timeframe with index funds. Nobody says it but these kinds of returns are almost guaranteed.

And because the wealth of the American nation is in the stock market, asset management companies need you to hold the index funds.

Hold them until retirement.

Hold them through corrections and bear markets.

Hold no matter what. Hold and the market will come back.

If you have a day job and contribute to your retirement fund via a 401(k) or Roth IRA, chances are your employer has a limited number of funds you can invest in. Those are true low-risk funds.

It’s like protecting people from doing dumb stuff in the stock market. Settle for more or less guaranteed returns and you’ll be OK long-term.

Because if the S&P 500 crashes and doesn’t come back, the US will become a poor country full of desperate retirees. It’s an extremely unlikely scenario, and it’s in part due to the incentive of holding index funds.

It’s akin to investors helping each other. The fund is stable as long as none of us sell.

Where most returns come from

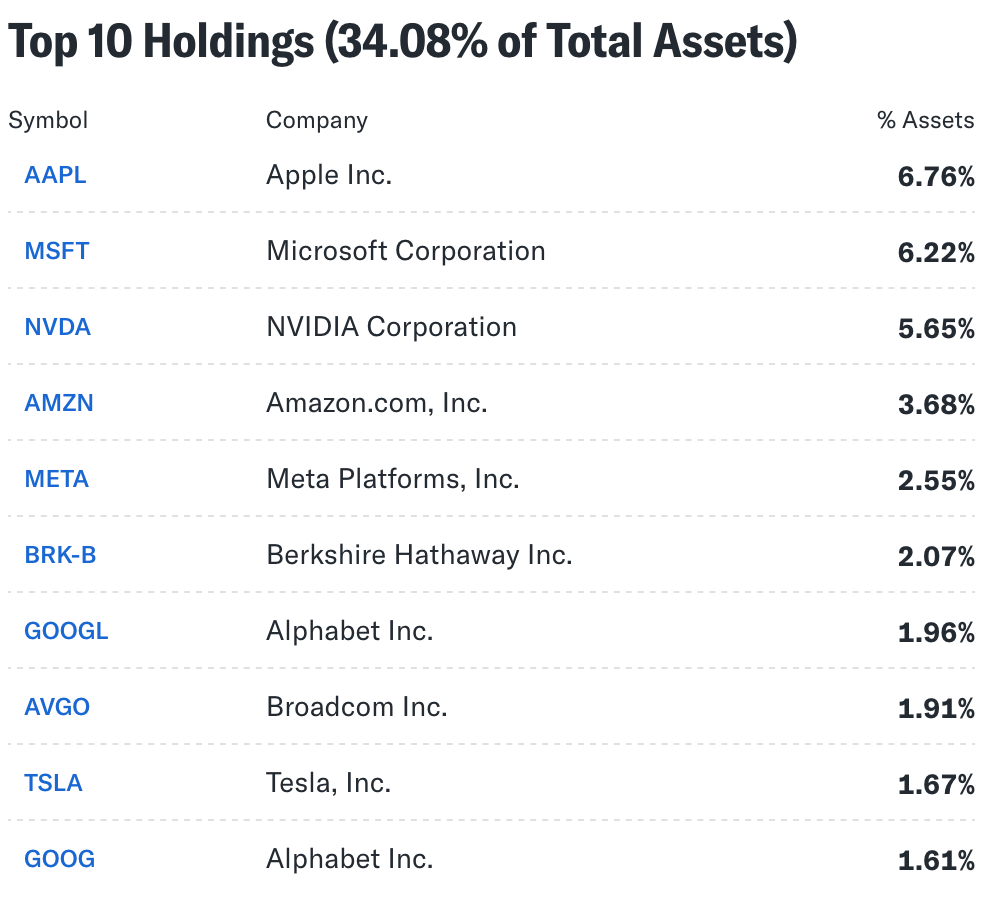

This table shows where most of the S&P 500’s gains come from.

If you invest $10k in the VOO ETF based on the S&P 500

$676 goes to Apple

$622 goes to Microsoft

$565 goes to Nvidia

$368 goes to Amazon

$255 goes to Meta

And the rest $7,514 goes to the other 495 companies.

Most of your returns come from five companies. The uneven asset allocation is the biggest danger with index funds.

And if you decide to pick another index fund, you won’t be better off. The QQQ ETF based on the Nasdaq index has a similar allocation.

Even MSCI World is severely skewed toward the American mega caps.

Sure, the mega caps are not all crashing at the same time. They have products and services billions of people use every day:

iPhones

WhatsApp

Amazon Prime

Microsoft Word

GeForce GPU (by Nvidia)

And the respective public companies have stood the test of time by surviving several recessions. They’ve always managed to reinvent and bring new technologies to the market.

But it’s only one reason why most of these stocks are growing. The other reasons are more of a concern.

Those companies have tons of cash

All the US mega caps face antitrust violations:

Apple over its App Store policies

Nvidia over its dominant role in AI chips

Meta over its acquisitions of Instagram and WhatsApp

Microsoft over software licensing, cloud (Azure), and AI practices

Amazon over anti-competitive practices in e-commerce and cloud computing

You shouldn’t ignore antitrust violations. Microsoft experienced that in 1998-2000.

And although the case was settled without a company break-up, Microsoft had to make its software more transparent. When you add the CEO change in 2000, the result was Microsoft stock stopped growing for sixteen years.

Anything can happen to the mega caps.

So why do these stocks grow beyond developing new technologies?

I’m aware of three reasons.

They all have tens of billions of dollars in cash that they use for share buybacks.

They’re part of hundreds of ETFs. As long as investors hold those ETFs, the stock prices are stable.

The companies’ image is polished. Retail investors love these popular stocks.

But the market sentiment happens to be volatile. No growth is indefinite. Every company experiences bear markets. And you can’t keep pushing stock prices by buybacks all the time.

Don’t count on the mega caps to grow forever. They could eventually harm the S&P 500. And it won’t be the first time.

After the dotcom crash, the S&P 500 spent thirteen years before hitting the 2000 high again.

Two ways to diversify your portfolio

I’d tell you how to properly diversify your portfolio beyond index funds if I had a crystal ball.

But investing involves uncertainty. Nobody knows the future.

I’m aware of two options you can reduce your exposure to the mega caps.

Option one is to add equal-weight ETFs. Those based on the S&P 500 contain the same stocks but the allocation is more even.

There are not many equal-weight ETFs so it’s easy to find one that suits you.

Option two is to add assets other than index fund ETFs.

My mother loves real estate and bought a second apartment. But my cash is invested. I’d need to take out a mortgage, which I don’t want to do.

Digital assets like stocks and crypto make sense to me. I invest 20% of my money in them.

They’re riskier but their upside is unlimited. Even if I’m wrong, I’ll be fine financially.

Consider adding digital assets to your portfolio

The takeaway

Don’t pick stocks or crypto if you’ve never invested. Index funds are a great low-risk tool to start investing.

As you get a feel for the market, you may want to consider adding riskier assets.

This is justified because index funds aren’t as diversified as they may seem at first glance.

Index funds have risks as do stocks and crypto. Evaluate your risk appetite and consider investing in the latter.

They could make you more money than index funds.

This article is for informational purposes only. It should not be considered Financial or Legal Advice. Not all information will be accurate. Consult a financial professional before making any major financial decisions.

P. S. I send out this newsletter twice a week. If you want to learn concrete investment ideas, hit the subscribe button.

You have a point! When you contribute to the company’s retirement account, they just ask for your retirement age and assign you a fund. It’s crazy to rely on just that.

The S&P 500 is extremely underweight in the sectors that are likely to outperform, such as energy.