Great companies aren’t those whose stocks grow by 300%+ in a year. It’s those whose stock prices are aligned with the fundamentals.

Palantir is not such a company. It’s soared since 2024 way above where it should be. You should only buy its stock now if you’re willing to seriously risk your money.

All the signs are there

When buyers evaporate, stock prices stall, and then fall.

Everyone who wanted to buy is already in. From there on it’s a slow long downtrend. Every morning you wake up hoping someone has just pumped the price. And every morning leaves you disappointed because the buyers went to other stocks.

You don’t need to be a financial analyst with a PhD in finance wearing an Armani suit to figure out when to close a position. There are screaming signs all over the place:

An almost vertical angle of ascent in the stock chart is unsustainable. When you see such an insane price run, congratulate yourself on being in a position. Yes, you invested in a solid company while its fundamentals were below the stock price. Now prepare to dump it and move on.

An insanely high P/E ratio tells you people are expecting too much from the company. It’s 434 for Palantir and 25 for the S&P 500. Kinda risky to hold Palantir.

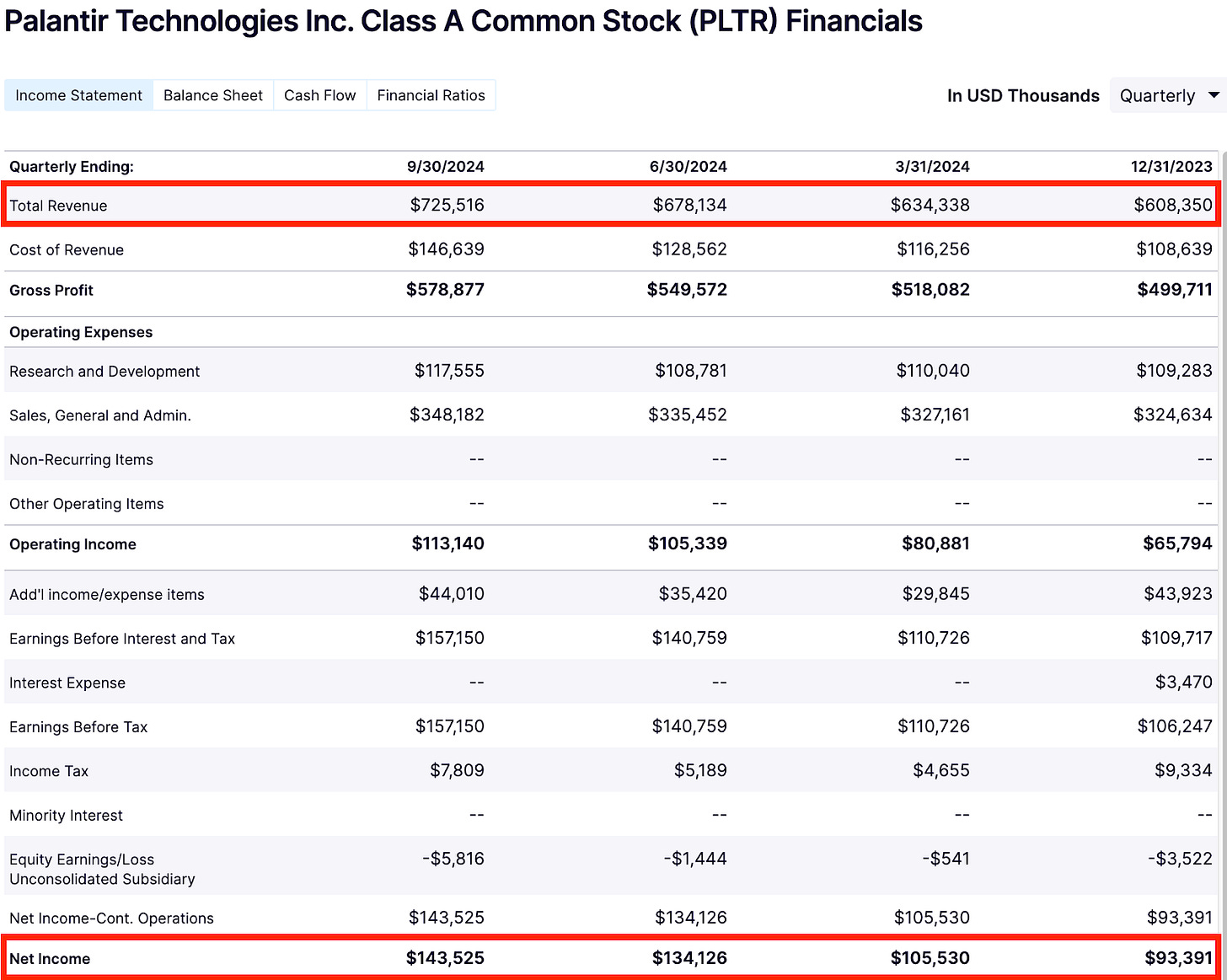

The price has grown on euphoria, not on fundamentals. Palantir’s revenues have grown by 30% over the past year. This is impressive but it doesn’t justify the stock price jump from $17 to $82.

I’m not saying Palantir is going under. It’s still a solid company, Alex Karp is still an amazing CEO, and Palantir still dominates the defense and government intelligence sectors. I’m saying the rampant speculation means the cycle of Palantir stock accelerated.

We saw during the Covid pandemic that a bunch of stocks got ahead of their fundamentals. Do you remember what happened to Zoom, Tesla, Peloton, Snap, and Paypal? They’re all household names that were in high demand during the pandemic. The money they could’ve made in three years, they made in one year.

Their stocks skyrocketed in 2020-22 and spent the next three years in downtrends. Snap still has not recovered.

The cycle of Palantir the company didn’t accelerate. It’ll keep making money. Only its stock price is a concern.

It’s your money we’re talking. You invest in a company at an astronomical valuation, you wait for years to break even (best case scenario) or lose money (worst case scenario).

Don’t obsess over one company

Amazing opportunities in growth stocks happen without euphoria.

The most screaming recent example is Nvidia. It’s had insane revenue and earnings growth over the past year. So its sky-high stock price is closer to the fundamentals than Palantir’s.

Nvidia’s P/E ratio is 101. Buybacks have helped to keep the high stock price stable. Nvidia is using them in a strategic way to keep its investors happy. (This week’s DeepSeek fiasco was pure panic selling.)

Palantir does buybacks as well. But they’re tiny. Palantir spends $19 million per quarter. It’s nothing for a company worth $182 billion. You only need one analyst downgrade or one Black Swan event for Palantir to crater.

I admit the stock’s downside is limited. Important people in finance believe in Palantir. It was just included in the S&P 500 and NASDAQ. More funds based on the US indexes must add Palantir. It’s part of even more ETFs now.

The ETF developers are long-term investors. As long as they hold the stock, they stabilize the price.

But institutional ownership of Palantir is 50% as of September 30, 2024. It means retail investors hold half the stock. They’ll dump it in a second if necessary.

So don’t assume Palantir is invincible. It already got pumped once way above the fundamentals in 2021 and ended up losing 87% of its peak valuation in 2022.

Long story short, Palantir stock has an uncertain future at the current valuation. It must boost its revenues and earnings significantly to keep growing. It’ll be interesting to watch what it does on the next earnings report tomorrow on February 3.

I’m not predicting what will happen once the earnings are out. The question to ask yourself is: Are you seeing its stock growing in the next few years? Palantir could be dead money for that long.

The company has a bright future ahead. Just don’t expect to make money immediately. Speculation harms public companies. It takes a long time for the fundamentals to catch up with a skyrocketing stock price. The best for Palantir is to settle into an intermediate- to long-term sideways trend.

There are 5,000+ stocks traded on the US exchanges. There’s always another Palantir.

This article is for informational purposes only. It should not be considered Financial or Legal Advice. Not all information will be accurate. Consult a financial professional before making any major financial decisions.

$102 after hours

Back in November I wrote articles about Palantir. Made videos. Talked alot about it. Never got in. Its my biggest regret of 2025.