The Apple Effect: How Technology Giants Distort Stock Market Indexes

It’s not only about index funds

My friend Tom had a puzzled look on his face on Thursday.

316 stocks in the S&P 500 went down. Yet Tom’s ETF based on the index was in the green. The conversation reflects a common misconception regarding the structure of index funds.

The devil is in the details.

Don’t fall for this trick

Here’s how the stock market is organized.

There are 11 Sectors:

Energy

Utilities

Industrials

Healthcare

Technology

Real Estate

Basic Materials

Financial Services

Consumer Cyclical

Consumer Defensive

Communication Services

They are further divided into 145 industries. The industries are all unique and contain a different number of public companies. For example, Biotechnology contains 691 stocks while Publishing has only 10 stocks.

Each industry has an index. The index gives you a rough idea of how the industry is doing.

An industry index is like a stock market index. But it focuses on a more specific group of companies selling similar products or services.

I want you to take a look at the industry called Consumer Electronics. It comprises 23 companies. Here’s its index (the y-axis isn’t price; it’s index value):

Apple is part of Consumer Electronics. Here’s Apple’s stock chart:

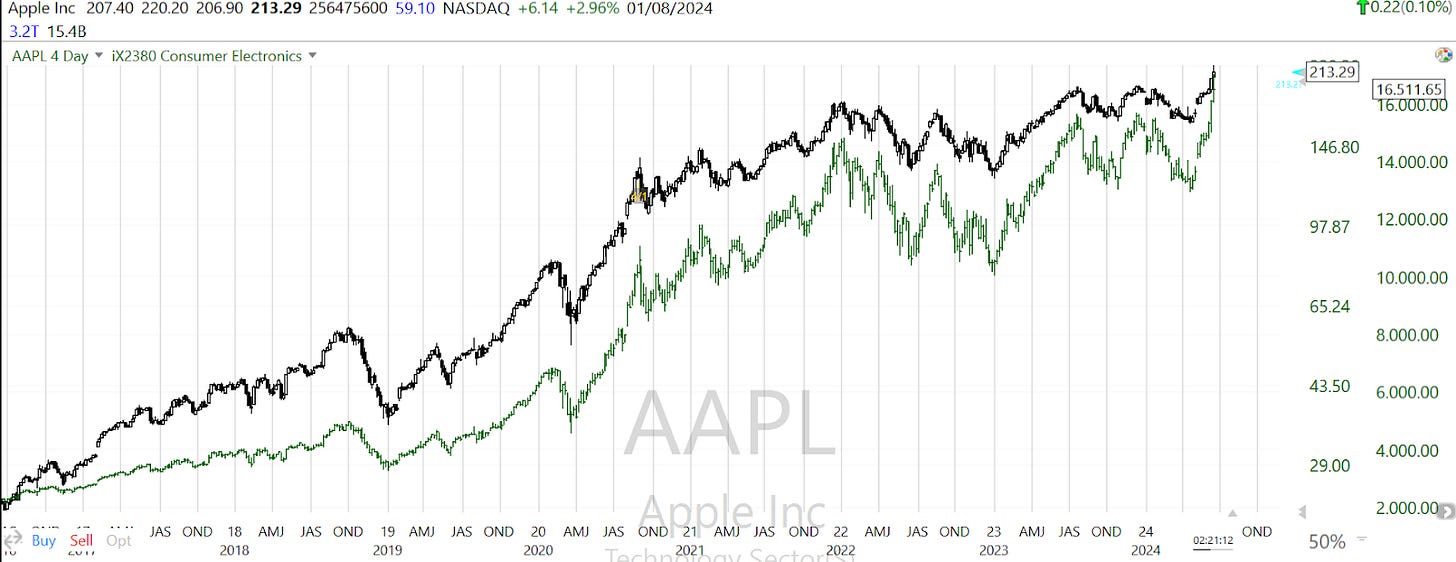

And here they’re together since 2016 when Apple became a giant:

Similar, aren’t they? Apple lifts the entire industry, distorting the index. This is the Apple effect.

You know the company GoPro? One that sells action cameras you can mount on a helmet. GoPro is part of Consumer Electronics too. Its stock chart is unlike Apple’s.

GoPro’s success story turned sour. Consumers bought those fancy cameras. The market got saturated in 2014. GoPro’s quarterly reports started bleeding red ink. The stock has been in a slump for a decade:

Apple is a towering skyscraper next to a modest house. The giant’s market cap is $3,2 trillion, GoPro’s is $237 million. It makes sense we can’t see what’s happening to GoPro from the industry chart.

Let me explain why this is alarming.

Index funds aren’t immune

What’s going on in Consumer Electronics impacts your portfolio (even if you’re not directly invested in Apple or GoPro).

I recommend holding part of your money in index funds. They’re diversified, contain the largest American public companies, and charge low management fees.

The weighting of individual companies in an index can be confusing. The largest companies hold the most weight in the traditional index funds like QQQ (based on the NASDAQ) and VOO (based on the S&P 500).

If you invest $1,000 in QQQ, $86,3 goes to Apple, $85,9 to Microsoft, and $82,1 to NVidia:

QQQ contains 100 companies. VOO contains 500 companies. But the issue remains:

A large chunk of your money goes to the same large-cap companies no matter the index. This isn’t a problem by itself. Your index fund keeps climbing up if those companies make more money.

NVidia is the star player in the AI revolution happening in front of our eyes. The company’s quarterly earnings have gone from $680 million in 2022 to $14,9 billion a month ago.

Apple unveiled new AI features this week. Its stock is on the rise too. So are QQQ and VOO.

But.

More than half of the companies in the indexes are struggling. You can’t see that unless you look at their stock charts. So it could be false to say,

“The economy is doing OK because the stock market is doing OK.”

Growth in the indexes comes from a small number of giants.

This poses a risk - QQQ and VOO could slump if something goes seriously wrong for NVidia, Apple, and the other mega caps.

If you want to protect your portfolio…

A bear market for the Big Tech will come at one point. There’ve been four since 2000. It’s when retail investors and smaller fund managers dump stocks in panic.

As a retail investor, you have way more freedom than a fund manager.

We piss in the pants during bear markets but throw money back into the market when stocks grow. Imagine stock prices soaring into the stratosphere. The investors in your fund see that and invest even more.

As a fund manager, you’re forced to buy more stocks even if you know they’re overvalued. So you buy until something breaks. And when it does, people will blame you and your stock-picking ability.

Be grateful you’re responsible for your own financial decisions and nobody else’s.

You can do two things if you get uncomfortable with the soaring stock or index valuations.

Diversify into different asset classes. It reduces your risk. It’s never wise to hold just one type of asset. Go for assets with minimal correlation like stocks and precious metals.

Consider equal-weight ETFs. They’re based on the same indexes but assign the same weight to each stock regardless of the company’s market cap. So if NVidia tanks, your ETFs probably won’t.

Above all, rely on your common sense. Individual companies can’t grow forever. When it comes time for them to correct, be clear to what extent they can affect your portfolio.

The bottom line

Giving the largest companies the most weight in an index is an ingenuous strategy to make investors happy. It works 99% of the time. But when it doesn’t, disasters happen like the dotcom crash.

Always keep in mind how traditional index fund ETFs are structured.

This article is for informational purposes only. It should not be considered Financial or Legal Advice. Not all information will be accurate. Consult a financial professional before making any major financial decisions.

Another approach is to just keep the index and not worry about it. For each sector or company that is struggling, others succeed. Trying to predict which sectors are in and which are out is impossible over the long-term, and is the main argument in favor of indexing. Don't forget, the S&P 500 adjusts its components every year, and they are always removing dogs and adding promising companies. This means a certain amount of rebalancing always occurs.

Hammer right on the nail again Denis. You are truly a smart guy. Equal weighted index ETF's comprise a lot of my portfolio. Sure I'm not seeing the huge gains others are. But I'm riding the wave and know I will feel more comfortable when this thing corrects. Remember I was in the business for 38 years. Seen it all. Black Monday (20% correction one day...that was scary),dot com bubble,recessions,etc. Not a matter of IF, but WHEN (trees don't grow to the sky). If you look at the total returns over 10 years of an equal weighted portfolio vs. pure S&P500 the results are almost (slightly lower)the same....oh...here in the US it's Father's Day...if you're a dad, then Happy Father's Day Denis!