The more I deal with banks, the more I realize that they keep shooting themselves in the foot.

The low-risk/low-reward mutual funds they sell will hardly make you any money. Customer service makes you lose a quarter of an hour on the phone before you can speak to anyone.

But the most obvious downside is money transfers. They used to take days. Some take a few hours nowadays.

They’re still too slow. This inefficiency created an opportunity that young fintechs can cash in on.

That’s why I like Paymentus.

How to facilitate payments without holding the funds

There’s a market demand for digital bill payments.

Paymentus (ticker PAY) is a payment processing platform. The main feature is instant money transfers 24/7.

Banks aren’t designed for financial transactions around the clock. They rely on outdated financial infrastructure. Plus they’re heavily regulated.

Instant payments are riskier due to cyberthreats, though.

This is why Paymentus aligns its platform with the NIST (National Institute of Standards and Technology) Cybersecurity Framework. It includes

Endpoint (like your phone) network security

Identity and access management

Compliance with regulations

Risk management

Data protection

Paymentus must also pass brutal audits (on-site checks by security managers) to prove they’ve locked down sensitive financial information with firewalls, encryption, and anti-hacking measures.

The platform is not a digital wallet like PayPal where you can hold a balance. Paymentus is a bill payment platform that connects payers, billers, and financial institutions.

When you pay a bill, your money is transferred from your bank or card, routed through Paymentus’s infrastructure, and lands in the biller’s bank account. If your bank and the biller’s support real-time payment rails, the transaction is instant.

Paymentus doesn’t hold its clients’ cash.

This is why you find a low figure for Total Liabilities on Paymentus’s balance sheet ($90,5 million, the company also has zero long-term debt).

Compare this with the Total Liabilities of Payoneer ($6,8 billion), a fintech that facilitates cross-border payments for businesses, freelancers, and online sellers and keeps the cash for withdrawals by customers at any time.

Instant money transfers

Paymentus is not the best fit for saying “Thank you” to a friend who paid for your dinner (it’s not Venmo).

It’s a bill payment infrastructure provider with a focused business model. Paymentus operates across different sectors like utilities, government agencies, and insurers with complex billing needs.

Paymentus’s moat is its proprietary Instant Payment Network. It connects banks, card networks, consumers, and billers. It supports various payment methods:

Digital wallets

Credit and debit cards

Direct bank account payments

Auto-debit or bill pay from checking accounts

You can pay online, in the app, at a physical location, or by phone. And Paymentus’s all-in-one model is a great solution for bill presentment, payment, and money movement.

Paymentus provides a secure transaction pipeline that connects 2,500+ billers and banks.

It partnered with Oracle to use its cloud infrastructure and software for boosting Paymentus’s reach and performance across large-scale clients.

I should mention an infrastructure layer the Instant Payment Network could use in the future: FedNow.

FedNow is a platform launched by the Federal Reserve in 2023. Its adoption has grown to over 900 institutions like small banks, regional credit unions, and large commercial banks like JP Morgan.

FedNow also offers instant payments for a fixed fee but it doesn’t do what Paymentus does: Billing, invoicing, and customer communication.

As of June 2025 there’s no evidence that Paymentus is using FedNow’s infrastructure. But a partnership could be interesting for Paymentus to attract more billers, boost the volume of processed payments, and upsell premium bill processing speed.

For example, US government agencies are expected to adopt FedNow. With the Instant Payment Network integrated with it, Paymentus could immediately win new clients.

Synchronized channels in real time

Paymentus charges fees for processing payments and offers additional services to billers.

Here are the main revenue streams:

Transaction fees are the core revenue. The fees vary by payment method (clearing houses, credit cards, bank transfers, etc.), volume, and industry type (insurance, healthcare, municipalities, etc.).

Subscription and platform fees are for large enterprises willing to use hosted billing portals, reminders, and real-time balance updates. These are long-term contracts because switching payment processors is complex and costly.

Premium add-ons are call center automation, interactive voice response payments, point-of-sale integration, refunds, and rebates.

Partnerships give Paymentus shared revenue and revenue from licenses and referral fees.

Financial technology is a competitive industry. Here are Paymentus’s rivals:

Stripe is integrated with platforms like Substack where I’m writing this. Stripe supports cross-border payments, Paymentus is active in the US.

Payoneer is great for cross-border payments as well. It’s used by freelancers and small businesses.

Neither platform is a good choice for large enterprises, and neither platform supports real-time billing. If that’s what you’re looking for, Paymentus is the platform to use.

ACI Worldwide and Fiserv offer real-time billing in addition to cross-border transactions.

Fiserv and InvoiceCloud are also focused on government and utility services.

None of them support transactions via synchronized channels.

With Paymentus, you can pay bills via a browser, a smartphone app, an interactive voice response, a walk-in, a chat, or an SMS. The payments and user data update automatically across all the channels.

Sexy financials

So Paymentus is in a competitive industry. It does what some of its rivals do.

It may not seem sexy until you look at the financials.

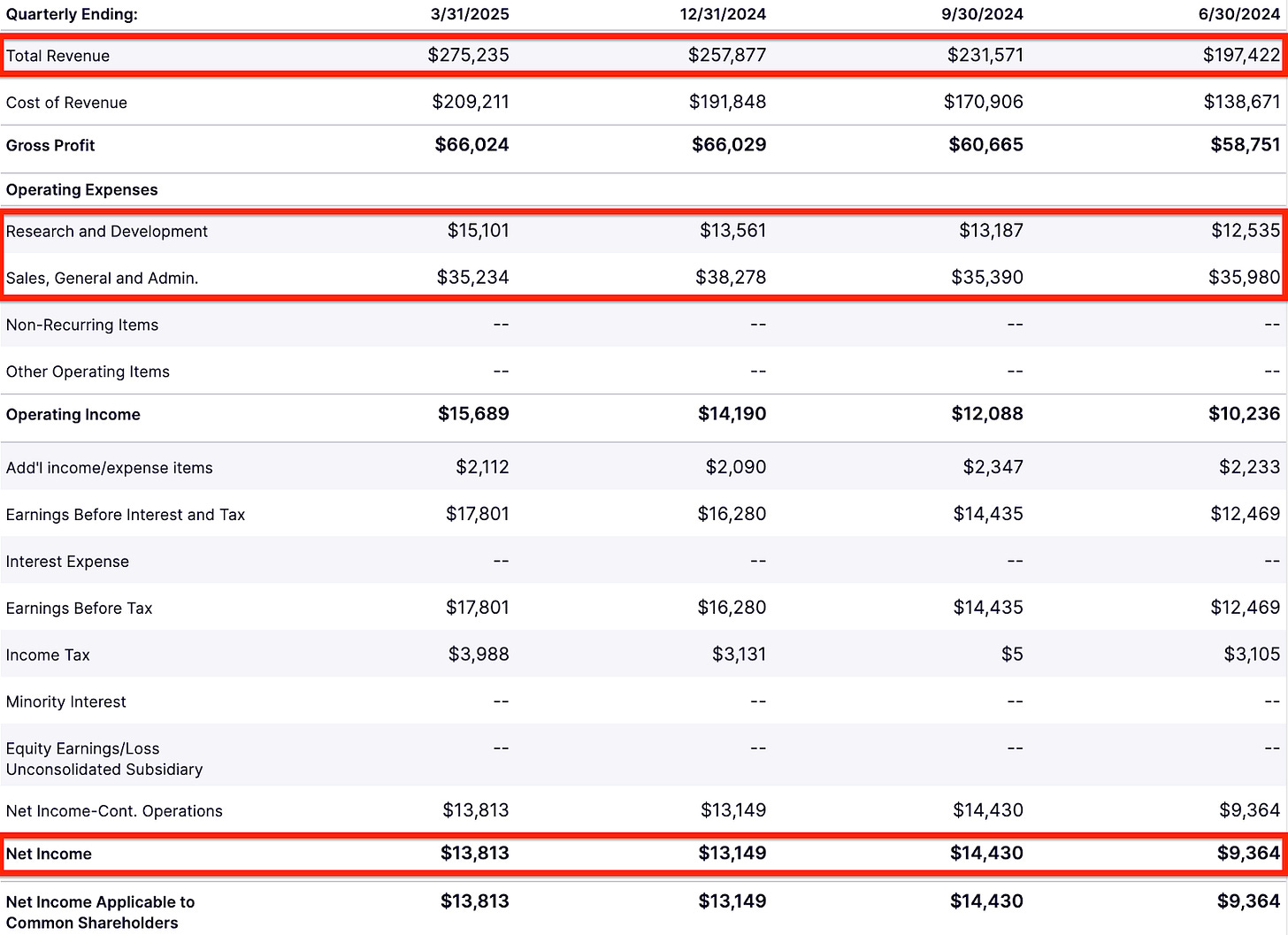

Revenue up 48% YoY

Zero long-term debt

Free cash flow $41 million

Stable positive earnings

Revenues are rising but earnings are flat. Take into account that Paymentus has the R&D and Sales expenses under control.

The company is investing in growth. Given its zero long-term debt, it’s conservative with leverage. So it reinvests the profits into the business.

Paymentus’s operating expenses per quarter climbed from $44 million to $50 million YoY. It’s likely funding its partnerships and tech upgrades.

The stock loves improving revenues.

The long-term technical patterns look promising. The stock tanked right after going public. It means the underwriter (the bank that helped Paymentus go public) overvalued the company and quickly offloaded the shares.

But Paymentus invested the proceeds from the initial public offering in growth. Now that it’s profitable and has rising revenues, its stock chart has almost completed the initial three-year-long bottom.

A good time to buy PAY stock is when it breaks out above the bottom completion level ($40) and stays there for a week or two. This level will then become the stock’s support.

That will be a sign of improving fundamentals, and PAY stock will be unlikely to breach that support.

Is more growth ahead?

Paymentus’s clients are utilities, government agencies, and insurers. These sectors aren’t sensitive to economic downturns. Client acquisition and retention are the company’s strengths.

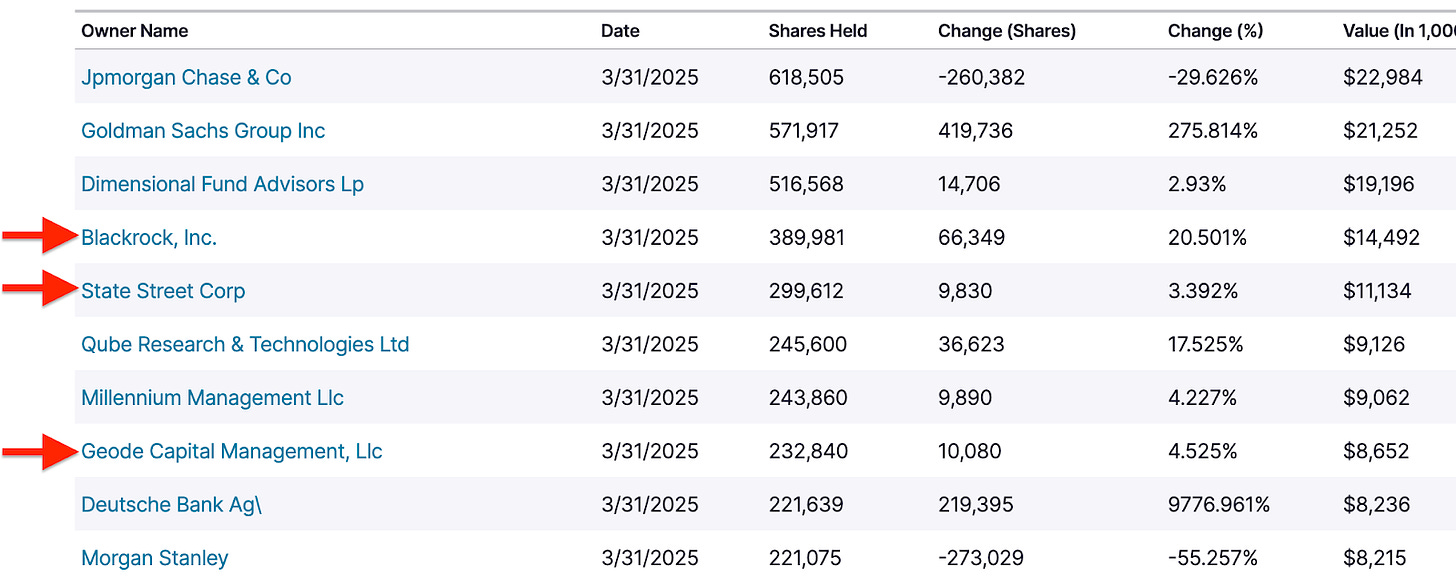

Revenue growth isn’t slowing down. Big-name institutional investors loaded up on the stock over the past quarter.

This figure is from Paymentus’s earnings presentation.

The opportunity is massive. Will Paymentus take advantage of it?

I don’t think Paymentus will corner the entire US bill payment market. But its stock chart suggests there’s potential beyond 3,6%.

Perhaps international expansion will come at one point as well?

The bottom line

Paymentus’s success story is simple.

The business is built around its Instant Payment Network that facilitates its relationships with large enterprises through its widely integrated platform and the challenges of switching payment processors.

Revenue growth of 48% YoY, profitability, and active investment in tech upgrades make Paymentus a promising growth stock.

This article is for informational purposes only. It should not be considered Financial or Legal Advice. Not all information will be accurate. Consult a financial professional before making any major financial decisions.

P. S. A big announcement is coming on Tuesday. Keep an eye on your inbox :)