Pagaya Technologies: A Profitable Disruptor of the Credit Market With 30% YoY Revenue Growth

It helps approve more people for borrowing

The credit services industry is going through a disruption.

Banks are no longer the gatekeepers of credit. The real disruptors are the middlemen that use AI.

You could think spontaneously that banks use AI to approve and decline loans.

It’s more nuanced than that. Banks still reject good customers who can pay them back.

That’s where an intermediary steps in. It re-analyzes the application, helps the bank approve more loans, then bundles the approved loans and sells them to institutional investors while taking a cut.

This is the business model of Pagaya Technologies.

A second-look tool for analyzing loan applications

Pagaya ($PGY) doesn’t originate loans.

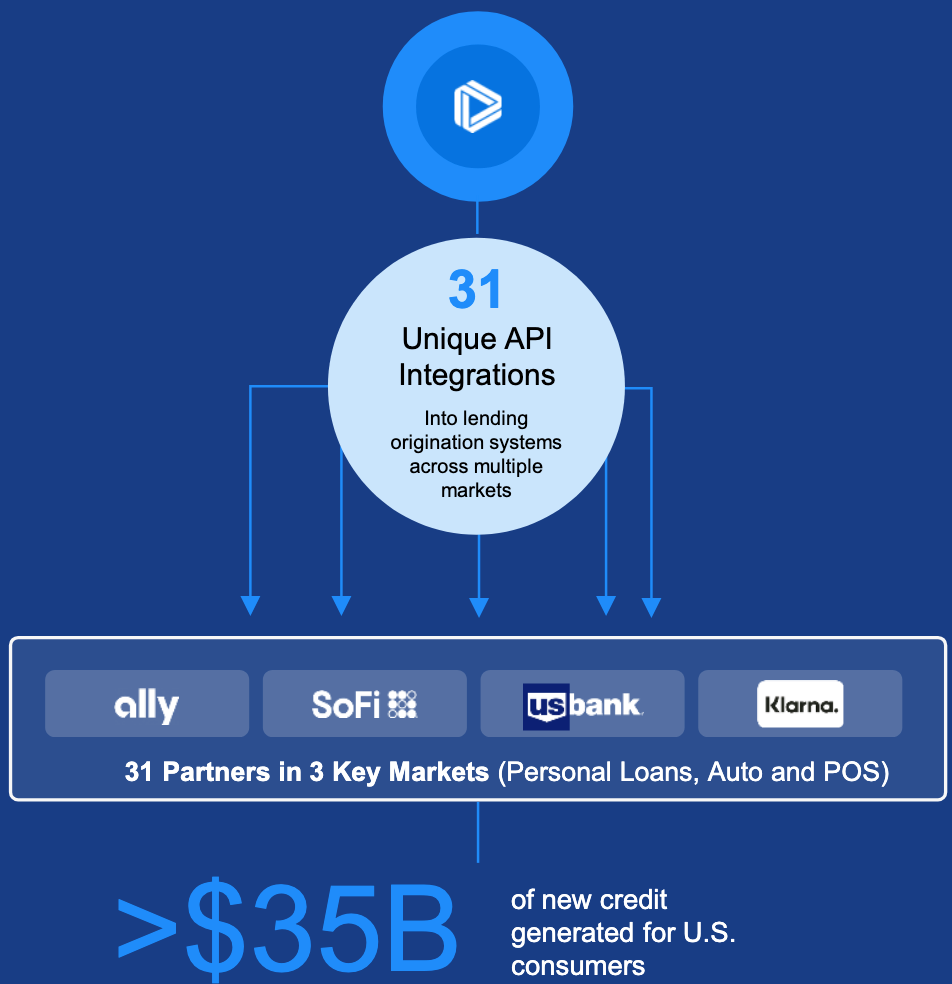

This fintech integrated its AI-driven platform into 31 financial services companies like Klarna, SoFi, and big US commercial banks. The platform assesses loan applications in real time.

The company is present in five credit markets:

auto

credit card

point-of-sale

personal loan

single-family rental

Pagaya’s platform goes beyond the traditional three-digit FICO credit score. It uses vast data sets that enable subtle selection criteria to determine borrowers’ creditworthiness. And it does so without increasing financial risk for the institutions issuing credit.

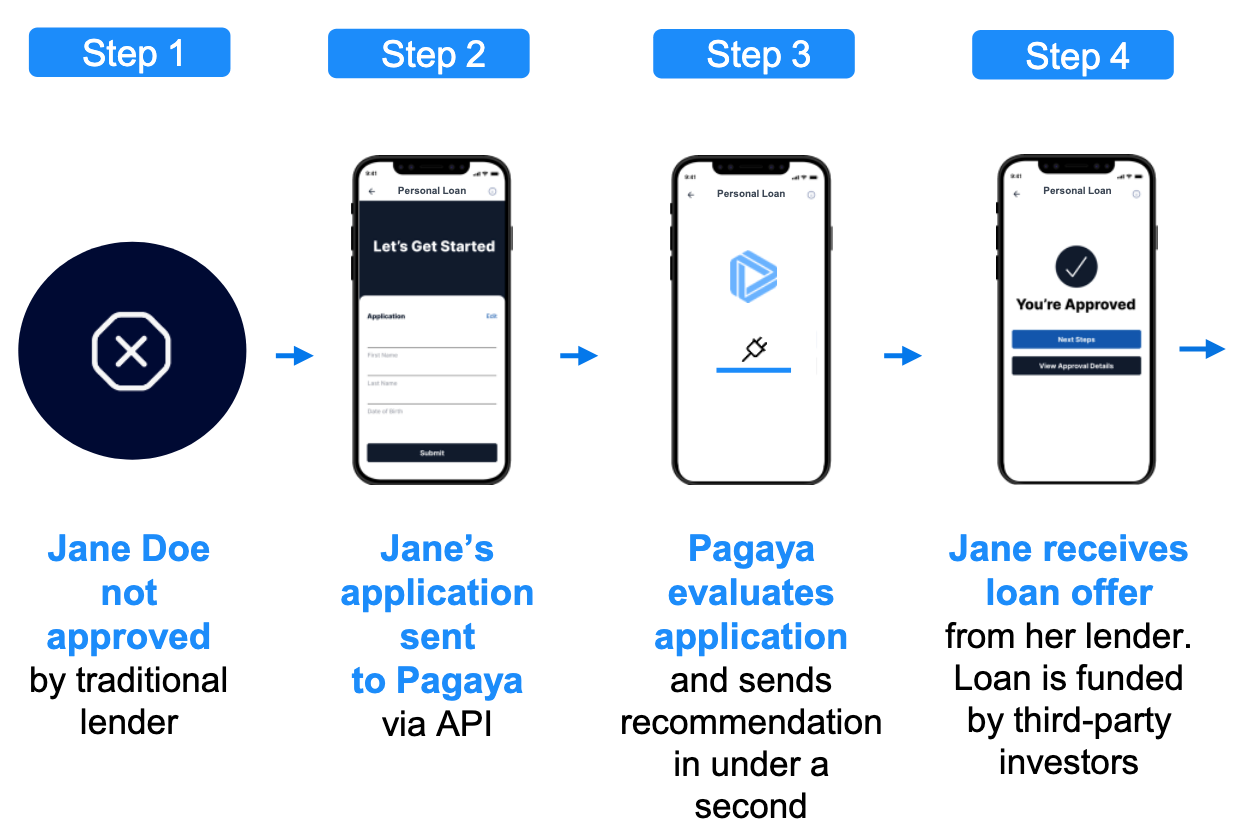

Pagaya is a second-look tool for an analysis of loan applications. A loan application is rejected by a financial services company first. Then the application goes to Pagaya which uses tons of data before recommending (or not) the approval of a loan.

The fintech analyzes macroeconomic trends, market conditions, and borrower-specific metrics like

education level

income stability

cash flow patterns

employment history

rent payment records

bill payment consistency

transactional data from bank accounts or payment histories

Pagaya’s machine learning model computes repayment likelihood by identifying correlations across various data sets related to a specific individual.

The company charges fees for approved loans. The fees are percentages of the amount approved. Because Pagaya doesn’t issue those loans, it doesn’t run the same risks as the banks that do.

Here’s how it works:

But it’s only half the deal. Pagaya connects lenders and borrowers with 145 institutional investors.

After several loans have been approved, Pagaya takes them off the balance sheets of the originators, bundles them into asset-backed securities, and sells them to institutional investors. Those are asset management firms, hedge funds, and insurance companies. Now debt repayments (principal + interest) go to the institutional investors.

This process also generates commissions for Pagaya. The commissions involve structuring fees (for bundling loans) and servicing fees (for ongoing management of the loans).

The fees depend on the size and type of the loans like personal, auto, or credit, and specific terms negotiated with the partners.

Pagaya doesn’t keep those loans on its balance sheet. Institutional investors do. Even if a borrower defaults on a loan, Pagaya’s direct risk is minimal (but poor performance could naturally impact future demand).

Now that it’s profitable, the stock is soaring

Pagaya’s financials are solid:

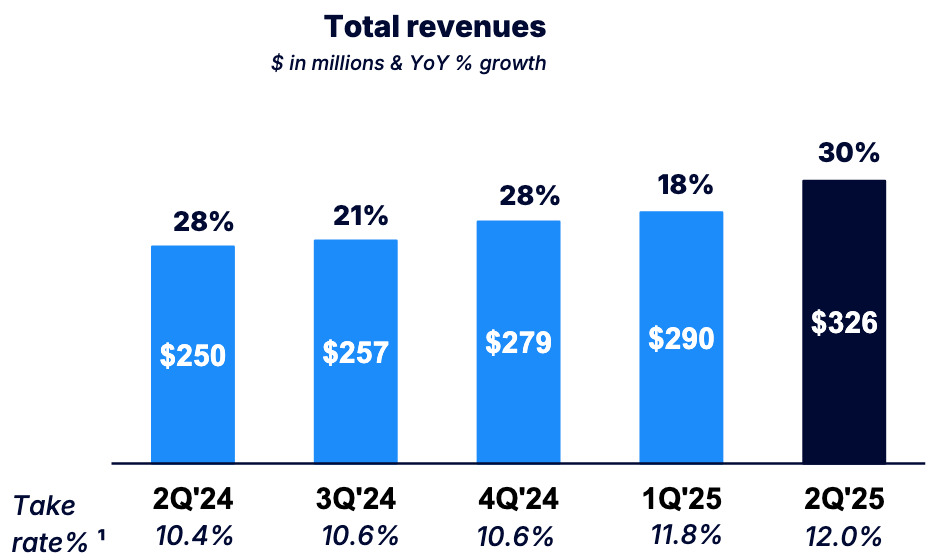

Revenue up 30% YoY

Revenue up 24% over past four quarters

Long-term debt $297 million

Free cash flow $110 million

Profitability over past two quarters

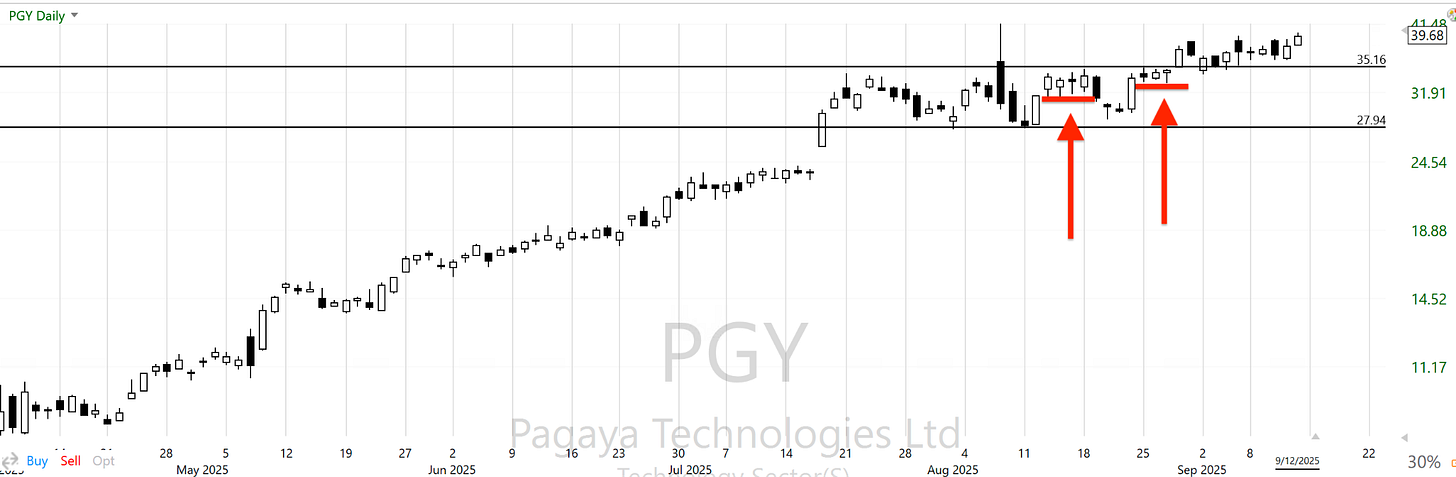

This fundamental improvement explains why $PGY stock has been on fire since April.

But stocks don’t grow all the time.

Sometimes they need to pattern out excessive gains. It can be a dip in price or a sideways trend. Both are corrections.

A sideways trend is better because it’s easier to see the company’s fundamental value.

This is what $PGY stock did in July and August.

The well-defined highs ($35) and lows ($28) signal an institutional buy zone. The run-up to the buy zone didn’t make the stock too expensive in relation to the company’s fundamentals.

Institutional investors kept the stock price at a new high.

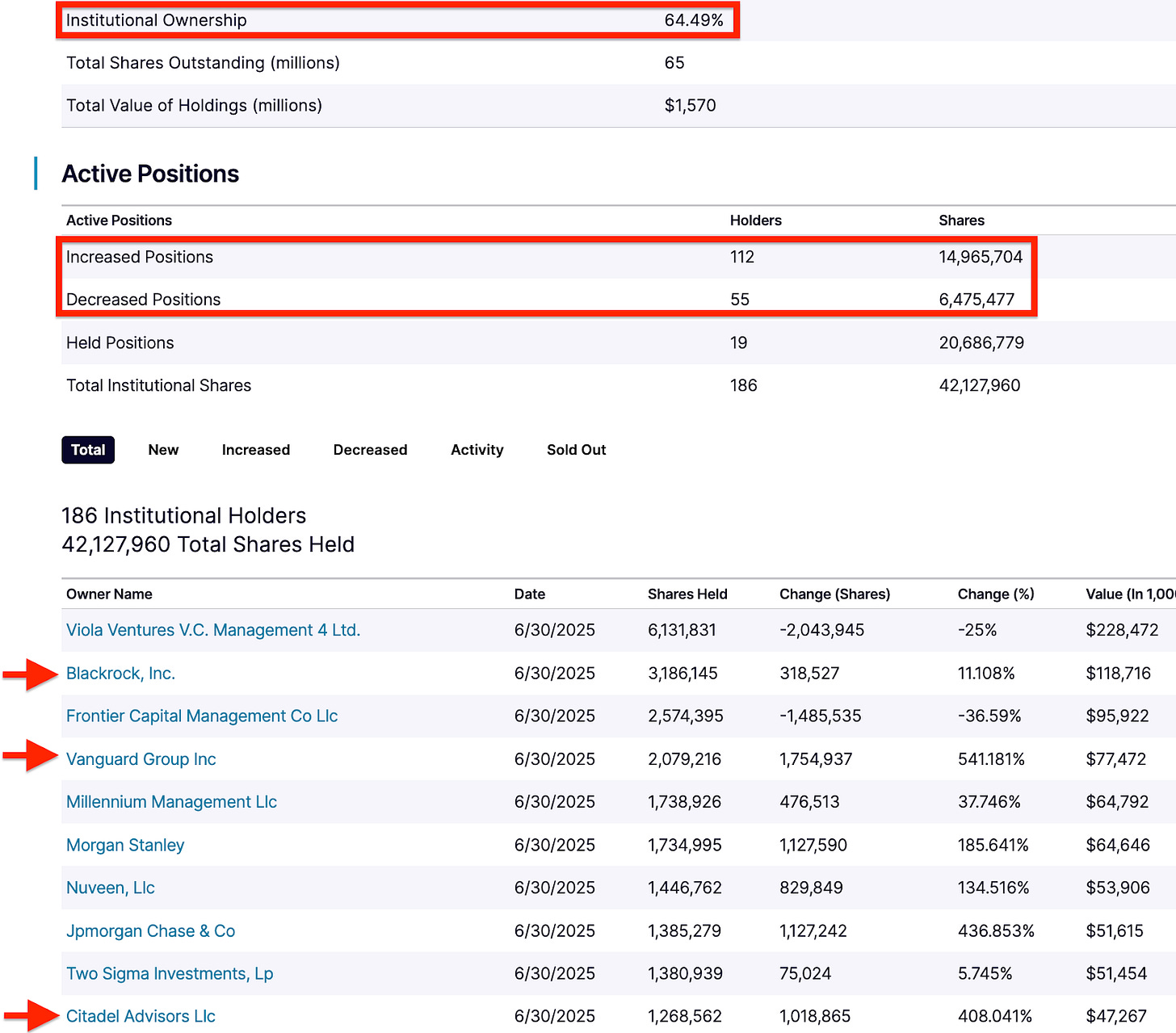

Here are recent data on the institutional ownership of Pagaya:

BlackRock, Vanguard, and Citadel loaded up on $PGY stock by June 30. I don’t think they stopped there.

Institutional investors buy stocks slowly to avoid disturbing their prices. The run-up of the $PGY stock price wasn’t driven by them. It came from professional and retail investors.

If you didn’t buy the stock before the buy zone formed, a good time to buy was just before the breakout above $35.

The price began to compress within the buy zone, fell, then went back to the high of the buy zone. Such a stable price at the high of a buy zone is a footprint of professional traders. They were expecting a breakout, and it came.

Now another buy zone (a sideways trend with well-defined highs and lows) appears to be forming. If this sideways trend doesn’t turn into another run-up, the price compression pattern could repeat.

$PGY stock price could be way higher if the company didn’t dilute its shareholders. It went from 54,5 million in 2022 to 75,7 million shares in 2025.

Over the past year, profitability has come, and the dilution has slowed down.

So Pagaya isn’t overvalued. Institutional investors are buying it. Its Price-to-Sales ratio is 2,9.

How much could $PGY stock be worth in five years?

Let’s say it’ll keep annual revenue growth at 24%

Let’s assume it’ll dilute shareholders by 5% a year

Let’s accept a 10% discount rate

We’re looking at $67 per share as compared to the current $39.

The risks with Pagaya aren’t serious at this point

The potential for Pagaya’s growth is enormous. 42% of US consumers don’t get the credit they apply for under traditional credit scoring models.

Pagaya also plans to add new lending partners to its vast network. It says it’s currently negotiating with 80% of the top 25 US banks by asset size.

However, there are risks with investing in Pagaya.

The first is dilution. Since it went public, Pagaya has added 39% of new shares to the float. Fundraising paid off because now the company is profitable.

Second is regulatory scrutiny. Regulators could for example demand Pagaya

Prove it doesn’t discriminate based on race, gender, or other categories

Be more transparent about how it bundles loans, which would make institutional investors more cautious

Hold more capital reserves for risk reduction

Limit its credit approval rates if it approves too many loans

Third is Pagaya’s competitors like Upstart Holdings could challenge it.

Upstart has more than 100 lending partners compared to Pagaya’s 31, but Pagaya balances that with 145 institutional investors buying its securitized loans.

Upstart makes money mainly from origination fees with bank partners. Pagaya goes further. It structures, bundles, and sells loans as securities.

If competition heats up, Pagaya could lose lending partners. But its model connecting lenders, borrowers, and institutional investors makes it less exposed to any single bank.

Upstart is bigger by revenue and just became profitable like Pagaya.

There’s no clear winner yet. Competition in a growing market is normal. It means both fintechs have room to grow.

The takeaway

Pagaya’s 30% YoY revenue growth and profitability prove its business model is gaining traction.

As long as we don’t face a recession that slows loan demand and raises defaults, the upside could outweigh the risks of investing in this fintech.

Consider Pagaya for your long-term portfolio.

This article is for informational purposes only. It should not be considered Financial or Legal Advice. Not all information will be accurate. Consult a financial professional before making any major financial decisions.

P.S. I publish this newsletter twice a week. If you want to see better-than-average investing opportunities, hit Subscribe.

What I find interesting is that they’ve cracked the chicken-and-egg problem in a way: enough lending partners to source loans, and enough institutional buyers to absorb them. That dual network effect is what Upstart still struggles with. The dilution risk is real though, but profitability plus BlackRock/vanguard buying in is not a bad signal. If they can lock in more Tier-1 banks, the optionality on volume growth is huge.