Germany Taxes the Crap out of Me. Here’s What I Do to Keep (and Multiply) the Money I Have Left

Legal ways to avoid capital gains taxes

Saying that my taxes suck is an understatement. I lose 42% of my paycheck before it hits my checking account.

To be honest, it’s not all taxes. Here’s a breakdown of where my cash disappears:

Income tax: 18,5%

Pension insurance: 9,5%

Health insurance: 7,3%

Long-term care insurance: 4,2%

Unemployment insurance: 1,3%

Solidarity surcharge: 1%

I’m not complaining, I’m just looking for a way to make more money. I have a good job in a high-income country.

Even though I only get 58% of my salary, I have enough to pay my rent, travel, and invest. And my health insurance covers a large chunk of my medical expenses.

Taxes make me remember Rich Dad, Poor Dad where Robert Kiyosaki says he used to be disappointed as a Xerox employee every time he saw how much he was losing to taxes. So he became an entrepreneur because

The taxes are lower

The income is uncapped

Having your own thing carries more risk but if your taxes suck, you could think of starting a business.

But wait, there’s another solution. The tax codes of most Western countries incentivize investing.

There’s a free allowance of 1k EUR ($1,1k) in dividends and capital gains in Germany per year. It’s double the amount per household if you’re married.

Capital gains beyond that are taxed at 25% plus a 1,375% solidarity surcharge. That’s a lot but still lower than 42%.

The 26,375% tax rate is here to stay. Germany has been thinking of abolishing the solidarity surcharge for a few years now. The tax was introduced in 1991 to even out the economies of West and East Germany.

We’re close to that point but how often do countries reduce taxes? I’d love to believe the state will make the country more attractive to investors. But so far we have an aging infrastructure and population that should be taken care of with our taxes.

The worst European countries for investors are Denmark and Norway. Both have a high standard of living but

Capital gains tax is up to 42% in Denmark and they’ll hike the retirement age to 70 by 2040

Norway has a 1% wealth tax (e.g., Norwegian chess player Magnus Carlsen paid 127% in taxes in 2023 due to his high net worth)

The chances of moving to a higher social class are slim in Germany. The state will take care of your medical treatment and unemployment and even give you some pocket change if you have kids.

It’s better than in most other countries. But what if you want to be financially independent before 67?

Reducing your expenses to boost your savings rate is the wrong answer long-term because it means putting financial constraints on yourself.

You could be in a temporary situation where you must have spending under control. But not buying a box of candies purely to save money will make you turn into a cheapskate and your family will hate you.

Here’s what you could do to boost your financial base instead.

1. Build a one-person business

Making more money is the most straightforward solution.

You can climb the corporate ladder or you can use your existing skills to build a business in your free time. It doesn’t have to be a large company with ten warehouses in the city and a thousand employees.

You can do so from home thanks to the Internet.

It comes down to finding customers who pay you for solving their problems. Thirty years ago you had to knock on people’s doors or call them to make them an offer.

Now you can use social media to attract attention and turn some of your followers into clients.

Boom, you have a second income stream.

2. Live where taxes are low

You can grow your wealth faster in Switzerland, Singapore, and the United Arab Emirates.

They have no capital gains taxes. However much you make in the capital markets, it’s all yours.

These places are more pricey than Germany, and moving to them will cost you some cash. But if you find a decent job there, the long-term profits outweigh the initial expenses.

3. Invest in assets that have a special tax treatment

The German tax code wants you to invest for the long haul.

I know three ways to legally avoid capital gains taxes.

First, Germans have strong reasons to look on gold and silver as stores of value: The hyperinflation of the 1920s and the post-WWII economic instability.

Some investors I know say that gold is boring and produces no cash flow, so why hold it?

It’s appreciated way more than other traditional assets over the past two decades when money printing has been the norm:

Gold price per ounce: $420 (2005) -> $3,357 (2025) -> 700% return

S&P 500: 1,190 (2005) -> 5,803 (2025) -> 390% return

If you measure inflation by the gold price and hold the S&P 500, I have bad news for you.

Gold bars and coins are treated as currency-like assets in Germany, which also exempts them from the value-added tax.

Gold ETFs are treated like stocks (26,375% tax applies beyond 1k EUR).

Physical silver is treated as a commodity but follows the tax rules for gold. Silver is used more in industries like electronics and solar panels and has well-defined commodity cycles.

The silver price doesn’t always go up. It peaked at $50 in 1980 and 2011. Being a long-term silver investor is dangerous if you have no exit strategy.

I hold physical gold and silver which I bought two years ago. No complaints about the returns so far.

Second, the same one-year rule applies to crypto in Germany. I don’t know the reason but my hunch is the state wants to stop people from speculating on this volatile asset.

Applied to Bitcoin, this is a good strategy. Bitcoin has a limited supply and a growing demand. Its price can only go up in the long run despite an occasional “Bitcoin winter.”

I’ve been buying Bitcoin every Friday for a year. No complaints here either.

Third, you can sell real estate in Germany without having to pay capital gains tax after ten years. Buying and selling properties is costly, and the government doesn’t want you to flip them.

Homeownership isn’t common here. Most of us rent and are OK with it.

I love the freedom of moving from one location to another in the city every few years. It takes time and money but the feeling of always having a choice is unbeatable.

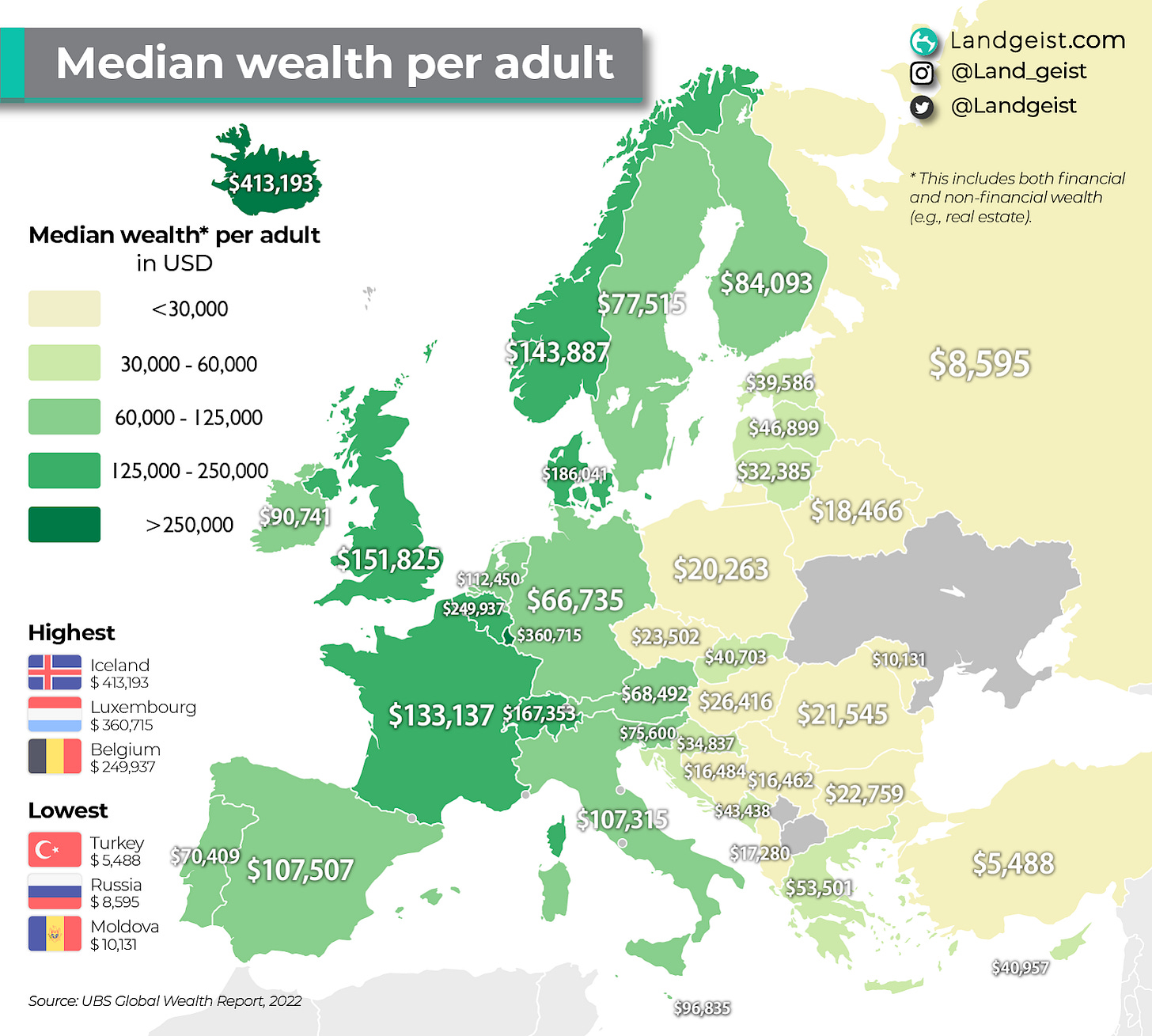

The consequence of renting is the low median wealth in Germany as compared to other European countries despite it being a rich country.

The takeaway

I hate to have 42% of my paycheck taken away. I hate risking my already taxed money and getting hit with taxes again on stocks and dividends.

So I added to my portfolio physical gold and silver and Bitcoin which I plan to hold long-term.

Study the tax code of your country of residence. You may find unexpected opportunities to keep more money from participating in the capital markets.

This article is for informational purposes only. It should not be considered Financial or Legal Advice. Not all information will be accurate. Consult a financial professional before making any major financial decisions.

P. S. I send this newsletter twice a week to help people make money in the capital markets. If you want to generate cash beyond your 9 to 5, hit the Subscribe button.

Excellent article and timeless advice on how to maximize your tax-saving options, even in a beautiful yet high-tax country like Germany.

By the way — Germany has recently joined the list of countries that impose an exit tax (which generally assumes you sell all assets upon moving and taxes accordingly). It's important to consider this when planning to move to or from Germany.

https://ffus.substack.com/p/exit-taxes-the-new-silent-asset-killer

Very solid breakdown, Denis. The figures, graphs and simple but concise language means that the layperson comes away with something useful and tangible.