Even With YoY Revenue Up 7%, This Old Venerable Company Behaves Like a Growth Stock

A great addition to a conservative portfolio

New technologies are the Holy Grail of investing.

The recipe to multiply your principal is straightforward: Find a young public company on the verge of profitability that does something few others do.

It would seem it makes no sense to look for a growth stock among the companies everyone already knows.

I usually ignore old venerable companies. They were good investments decades ago.

But there’s one or another that makes you stop in your tracks. And you don’t necessarily study its fundamentals as the first step.

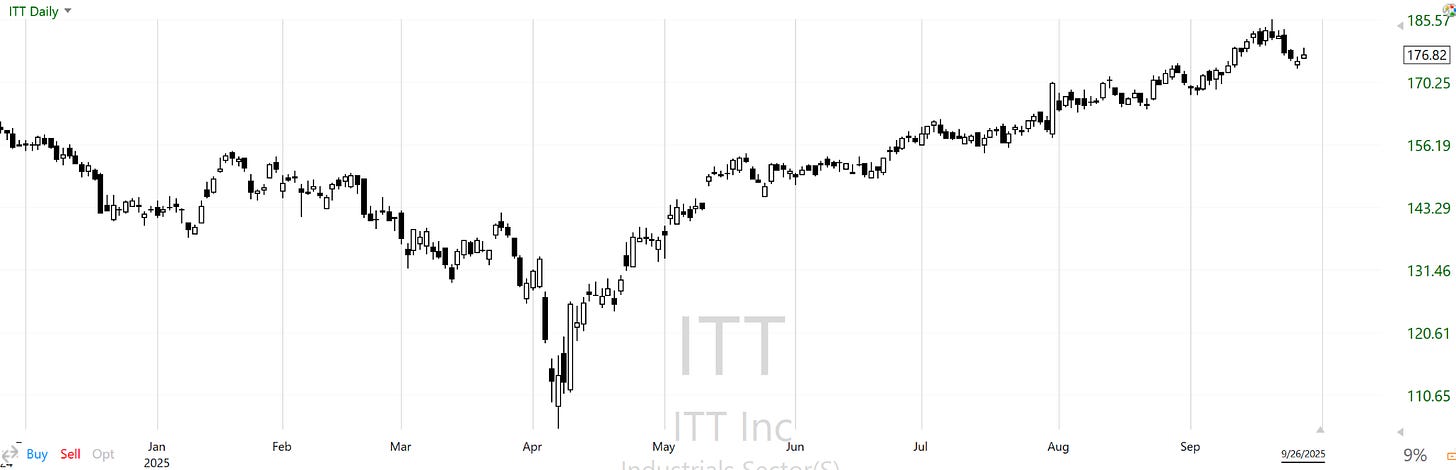

You look at its stock chart and see something interesting happening.

Hold your breath when you see professional activity

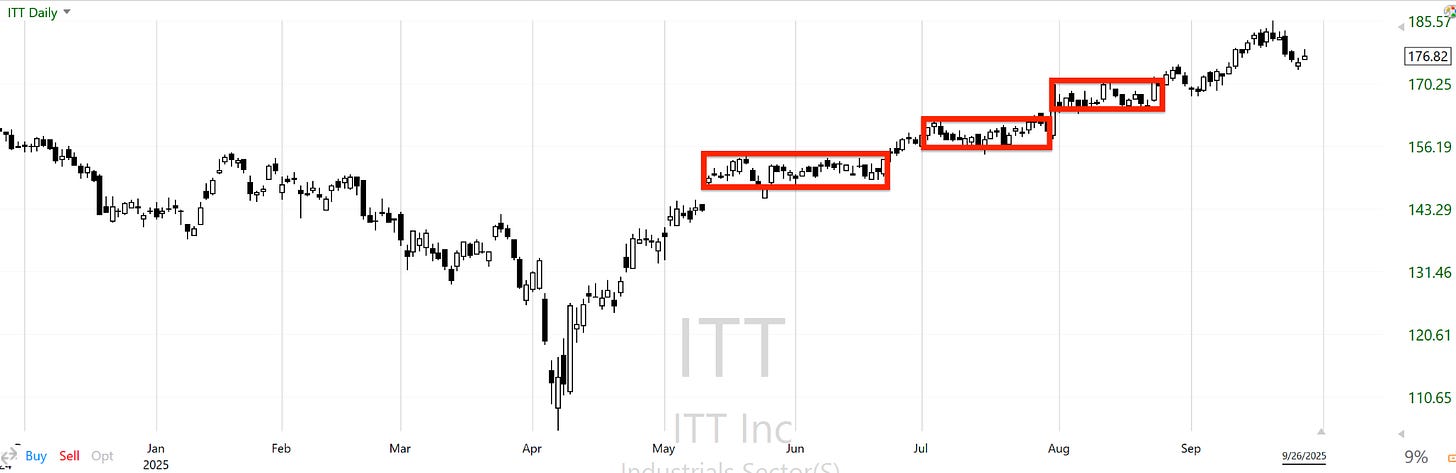

This stock chart caught my attention.

What’s so special about it?

It is what professional traders call “building platforms.” Can you see them on the chart?

The platforms are tight short-term price consolidations. They’re the footprint of institutional accumulation and professional trading activity. This strongly suggests the stock is undervalued.

Let’s look at the fundamentals of ITT Inc. to check if this is true.

The company retains three segments for better focus

ITT Inc. has this ancient name, International Telephone & Telegraph. It was founded in 1920.

Over the years it acquired hotels, insurance, defense electronics, and more businesses. ITT rose to prominence as a large conglomerate.

Telecommunications were part of ITT’s operations which it sold in 1986.In 1995 it sold its hospitality segment. In 2011 it spun off its defense segment.

ITT is in the industry Diversified Industrials. It has a bunch of orders from the industries Auto Manufacturers, Aerospace & Defense, and Oil & Gas.

ITT has three business segments.

Motion Technologies is focused on products that keep vehicles safe and reliable. The star of the business is brake pads. ITT develops advanced friction technologies used by cars, trucks, buses, and trains.

The parts ITT manufactures are precision-engineered for durability, performance, and safety. Beyond brakes, the segment produces shock absorbers and sealing solutions for smooth rides and efficient engines.

When a car slows down safely or handles better on the road, there’s a good chance ITT’s technology is involved.

Industrial Process develops and manufactures industrial pumps, valves, and systems that move liquids through pipelines or into processing facilities.

The pumps are engineered to withstand extreme temperatures, pressure, and corrosive materials. ITT also provides services like monitoring and maintenance of the pumps.

Connect & Control Technologies makes connectors, switches, and specialized aerospace components that operate in harsh environments. You can find those components in airplanes, defense systems, and medical devices.

For example, in jet engines, ITT’s parts help manage fuel and hydraulics. In medical devices, they ensure precise control and safety as medical devices become more sophisticated. ITT’s role here is to produce components for connectors, control interconnects, and flow control.

This segment benefits from the huge financial boost due to the current geopolitical tensions, the new space race, and advances in healthcare technologies.

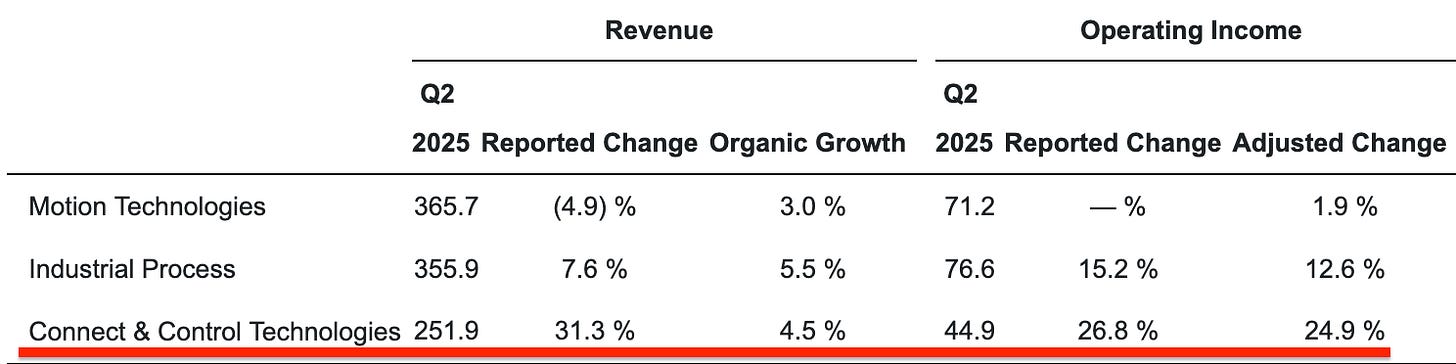

ITT’s latest financials show how the individual segments are doing:

ITT is re-shaping its operations to boost focus on aerospace, defense, and the industrial sector.

In 2024 Motion Technologies sold off its Wolverine business (an automotive supplier) for $48 million. That resulted in the (4,9)% decrease in the YoY revenue change.

Industrial Process raised its revenue due to a higher demand for pumps and better pricing actions.

Connect & Control Technologies profited from the acquisition of kSARIA in 2024. It’s a company that manufactures mission-critical connectivity solutions (cables made from copper, fiber optic, and hybrid assemblies) for defense and aerospace.

The financials are good and they’re going to get better

ITT is a good fit for conservative investors. The company is growing but certainly not on steroids.

Financials:

Revenue up 7% YoY

Revenue up 6,7% over past four quarters

Long-term debt $622 million

Free cash flow $137 million

Five more points underline ITT’s strong financial position:

1. ITT does share buybacks

It’s reduced its share count from 88 million in 2020 to 78 million in 2025.

2. ITT is profitable

It even pays a dividend with a 0,77% yield.

3. ITT gets more orders

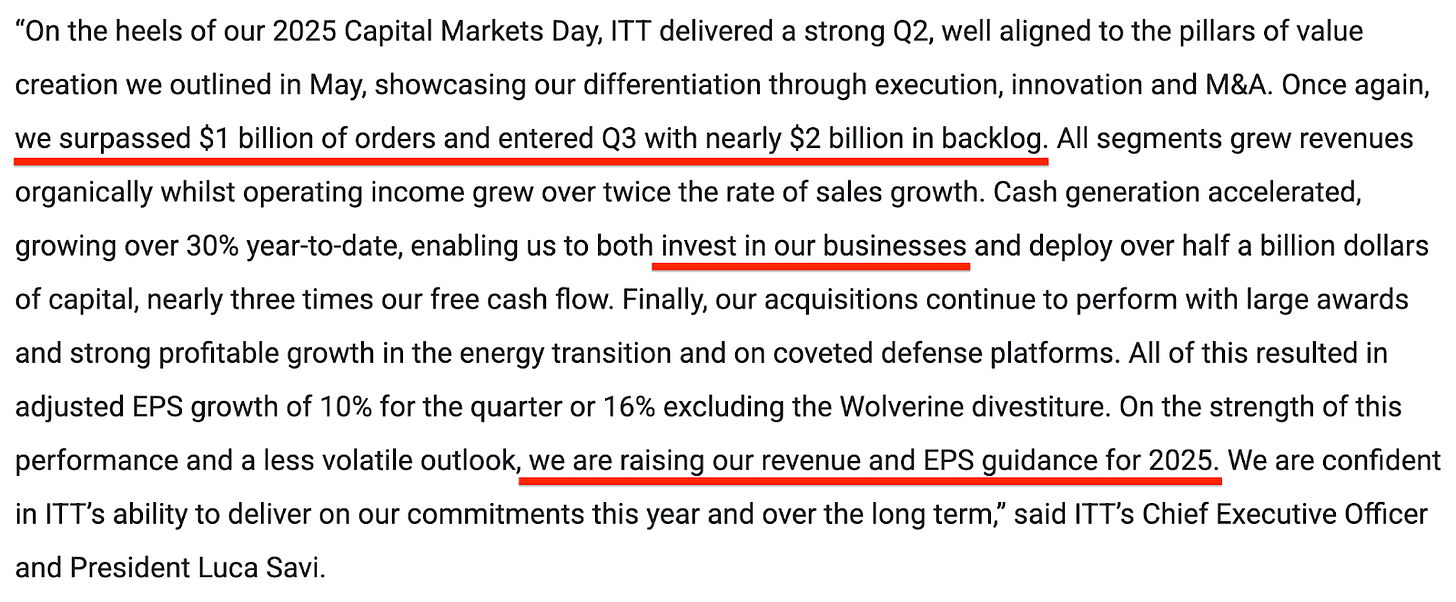

Last quarter ITT surpassed $1 billion in orders. The company has a backlog of $2 billion.

4. The rising number of orders leads to accelerated cash generation

ITT reinvested the profits and raised its revenue and net income guidance for the next quarter in 2025.

The CEO sounded optimistic:

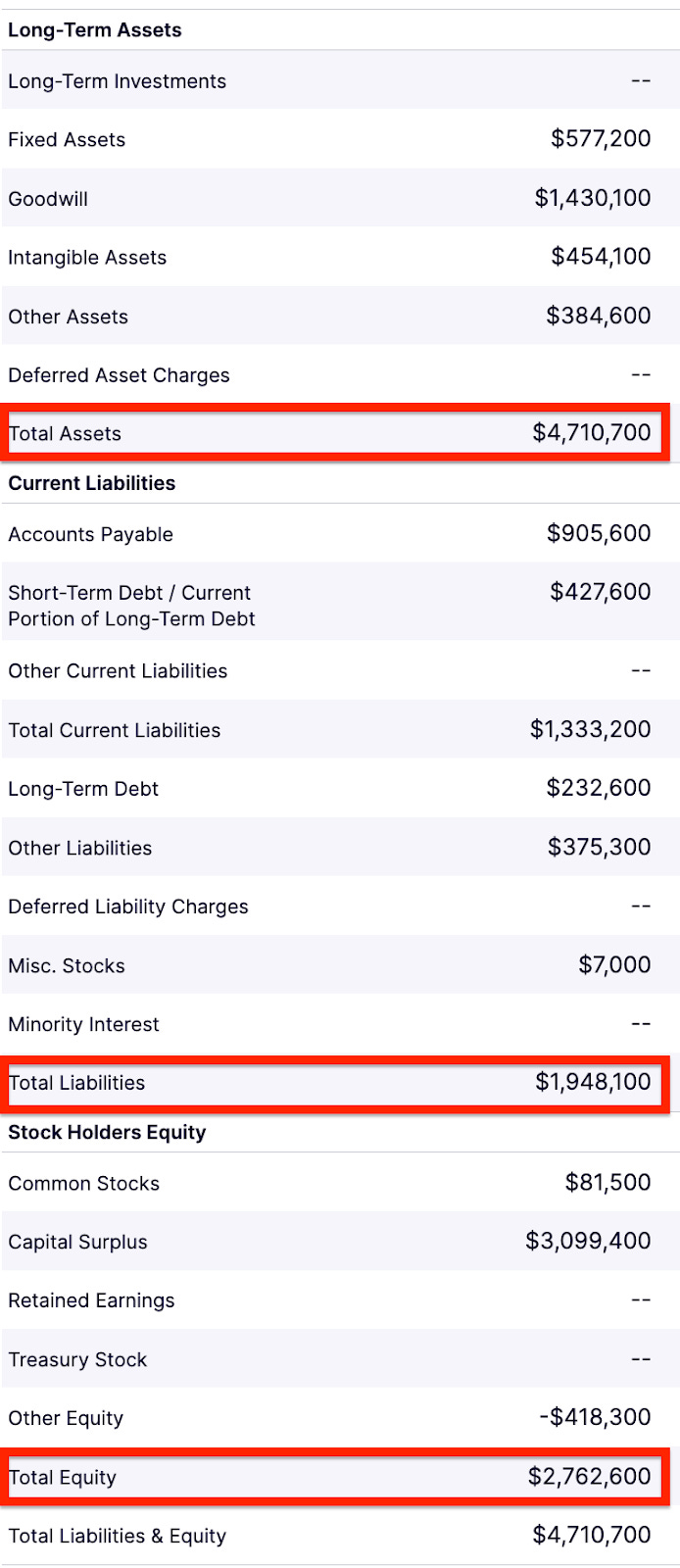

5. ITT has a healthy balance sheet

The total liabilities are 41% of the total assets.

I believe ITT has a significant long-term upside. ITT’s three segments operate in industries that are expanding and modernizing.

Motion Technologies: The demand for brake pads and automotive components is growing. The global car production is on the mend. Electric vehicles (EVs) are becoming more widespread, and they need advanced braking systems.

The braking systems have higher performance requirements. Specifically for EVs, regenerative braking recovers energy and recharges the battery. Brake pads must be quieter, more durable, and perform under harsher conditions. ITT is developing them.

This is in contrast to the traditional hydraulic friction brakes. They’re still used in EVs for emergency braking but they’re no longer the most efficient type.

There’s a need for novel brake pad materials and electronic braking distribution systems.

General Motors, Ford, and Stellantis are all ITT’s customers.

Industrial Process: The industrial infrastructure is aging across the world.

Take the US. The country has a problem with water and wastewater systems (leaky pipes, aging sewage network). Many components were built by the mid-20th century. Upgrades are urgently needed that involve pumps, valves, and advanced monitoring systems.

It’s ITT’s specialty. And it also has a presence in Italy, the UK, Germany, and the Netherlands which could all profit from similar solutions for their water and wastewater systems.

Italy and the UK have aging infrastructures. Germany and the Netherlands are known for excellent wastewater treatment and are investing more in it to meet the growing demand under climate change.

Connect & Control Technologies: Defense spending is rising worldwide. There are three reasons:

Rising geopolitical tensions

The commercial aviation sector is growing as people travel more

The new space race

ITT provides connectors for avionics and communication systems, devices for fuel and hydraulic systems, and flow-control components that can operate in extreme temperatures and high-vibration environments. The company serves aircraft and spacecraft manufacturers.

By 2030 ITT is aiming for a compound annual growth rate of 10%.

The takeaway

ITT’s financials speak for themselves. The rising revenues and earnings, neat balance sheet, share buybacks, and dividends say it has finances under control.

The company is cashing in on several global trends in the 2020s:

Rising demand for electric vehicles

Aging infrastructure

Geopolitical tensions and space race

ITT is a great fit for the conservative part of your long-term portfolio.

This article is for informational purposes only. It should not be considered Financial or Legal Advice. Not all information will be accurate. Consult a financial professional before making any major financial decisions.

P.S. I send out this newsletter twice a week. If you want calm no-hype investment ideas, hit Subscribe.

It has potential given its trending performance history but tends to swing violently. Requires patience and wide stoplosses.