Day Trading Is for Losers. You Make the Most Money by Investing for the Long Term

Don’t trade if you’ve never learned it professionally

People trading stocks on their phones delude themselves into thinking they’re smarter than the market.

I frequently bring up the issue on social media. Some people disagree. One asked me “Why is day trading such a big deal for you?”

I paid money to learn trading from professionals. Trading is their bread and butter. And they don’t day trade. They hold stocks for several days to several weeks.

I never became a trader because it started to turn into a full-time job for me. Keeping an eye on my stocks every day is time-consuming. I prefer to be a long-term investor.

Trading on your phone is gambling.

The professional approach to any type of trading is different and frankly, it’s the only one that works consistently.

I don’t believe anyone can make money reliably by day trading on their phone. If they say they can, I’ll ask them to show me their tax statement. They pay taxes on their capital gains, and their tax declaration should show that.

Do you know anyone who turned into a millionaire by playing with their money in a trading app?

Let me dissuade you from day trading.

The four-step analysis you should do before trading

As a trader, you don’t just buy a stock because you feel it should go up. You buy it because there’s a confluence of factors elevating the probability of it growing.

First, you figure out who controls the price

You don’t want to be part of an emotional crowd that buys on euphoria and sells in panic. Your best entry is when the professional side like pro traders or institutional investors have stabilized the price or reversed a trend.

With thousands of people trading a stock across the world, a price that suddenly looks stable or abruptly changes direction hints at something interesting happening.

You don’t trade until a specific price entry signal has formed.

Second, you check the volume

The trading volume for your stock should be on the rise.

There must be someone else willing to buy. A declining volume favors the downside even when there are few sellers.

And here’s the bad news: A huge chunk of transactions takes place off the public exchanges. That’s how institutional investors buy and sell stocks among themselves. They want to keep their activity hidden.

The volume will eventually show up in the chart but every transaction must go through a clearing house first. By law, it follows a T+1 settlement cycle (trade date plus one day). Which means you might not be able to see the volume in real time.

Third, you check supporting indicators

You should always keep an eye on the indicators that show you large lot (> 50k shares) vs small lot (<50k shares) transactions. Large lots usually mean the professional side is involved.

If you’ve never used indicators like Time Segmented Volume that show you exactly this, the chances of making money consistently from day trading aren’t high.

And you have to pay for those indicators. TradingView or your broker won’t provide them for free.

Moving averages won’t help you. They’re lagging indicators, whereas large lot vs small lot are leading indicators. They tell you about an approaching uptrend so you enter a position before the stock soars, not after a moving average confirms the move.

Think about it this way: If millions of people are seeing the same moving averages you’re seeing, you have no edge.

You’re doing what everyone else is doing, which nukes your chances of being in a position early.

Fourth, you evaluate your risk on the trade

Every trade involves risk. You need to put numbers on it. Not in percentages but in dollars.

Percentages make people emotional. “I’ve made 10% on this stock” doesn’t pay your bills.

You ask yourself instead “How many dollars can I earn or lose?” You should risk $1 to potentially make $5 or more, not the way around.

You should always quantify your risk while trading.

It’s not the right market for day trading

Day trading was a thing in the 1990s when stock prices were quoted in fractions like $12 ⅛ instead of $12,12 now.

That resulted in wide spreads so a day trader could quickly buy a stock for $12 ⅛ and sell it for $12 ¼. Day trading was fueled by the approaching dotcom bubble and the rise of online brokerage platforms.

Decimals (stock prices quoted as $12,12) were introduced in 2001. They led to tighter spreads and made day trading less profitable.

Over the years, the stock market has become more automated. Most transactions nowadays trigger without human intervention, sometimes on a less than a millisecond time scale.

One particularly dangerous market participant group is High Frequency Traders. These are computer algorithms programmed to send a large number of buy and sell orders in response to the news around a specific public company.

When a company publishes an earnings report, its stock can soar or tank by tens of percentage points in less than a second. That initial price rise or fall you see right after an earnings report, that’s High Frequency Traders.

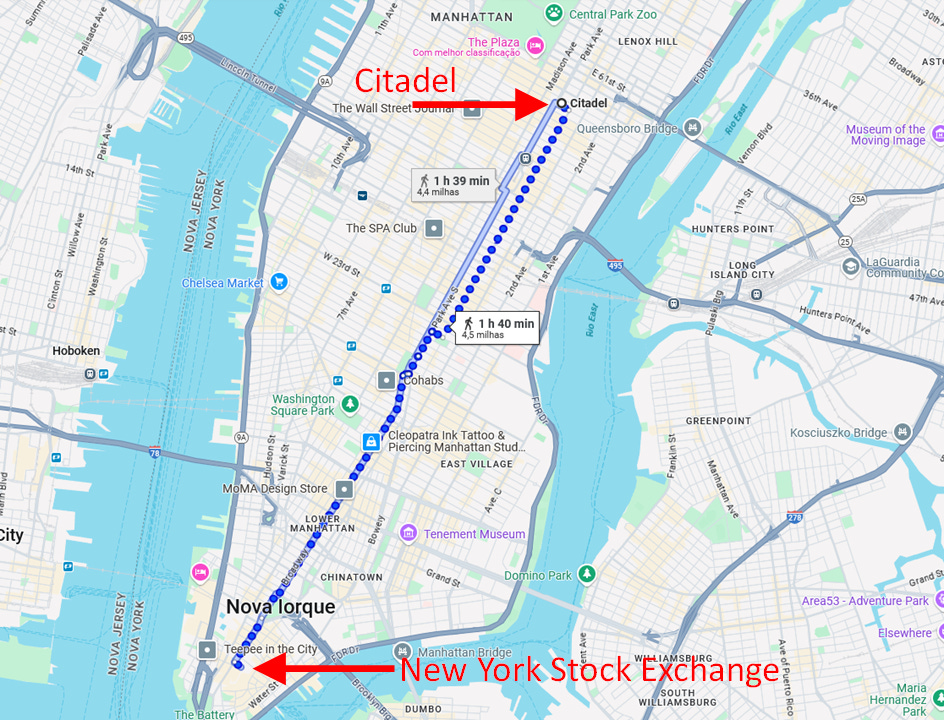

High Frequency Trading firms like Citadel are located close to the public exchanges. This is how close it is to the New York Stock Exchange (4,5 miles).

Moreover, High Frequency Traders use optical fibres that allow signals to travel at 200,000 kilometers per second, comparable to the speed of light.

These market participants trade faster than anyone else. They also trade during market open.

They’ll front-run your orders because your broker executes them within seconds. You’ll buy your stock at a higher price without realizing it.

You have no chance against those predatory firms.

Official stats confirm day traders’ dismal success rate

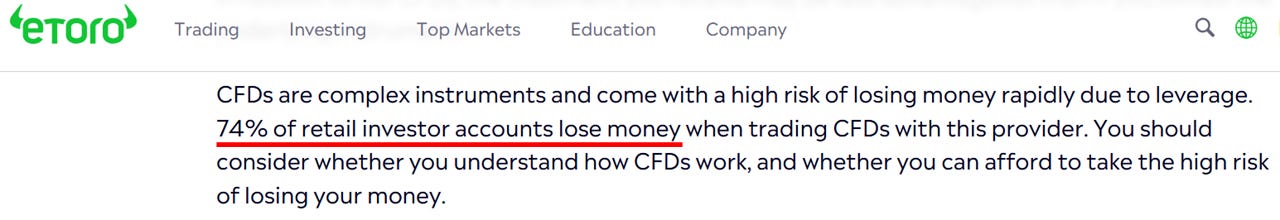

Popular retail brokers don’t make it a secret that most of their clients lose money.

Here’s what the European broker eToro says:

Just google “how many traders lose money” and you’ll learn that you’re very likely to be on the losing side of your trades. The percentage of unsuccessful day traders varies from 70% to 95%.

Your broker doesn’t care if you make or lose money on a stock. The broker charges a commission anyway.

As a long-term investor, you don’t make your broker much money. But if you trade, you buy and sell often. Your broker has every reason to incentivize you to be “active” on the platform.

You get addicted to the gamifying features of trading apps. This is what happens if you feel the urge to check and adjust your portfolio every hour.

And even if you make a profit from trading, you’ll pay taxes on your capital gains. You risk your hard-earned money, earn a few percentage points, and get taxed for the second time.

The hassle isn’t worth the risk.

You have no edge unless you’re an insider

It’s sad to admit this but the capital markets aren’t fair. Wall Street says “Someone always knows.”

The largest asset managers like BlackRock and Vanguard know in advance the growth prospects of public companies. Those financial services firms talk to the boards of directors of the largest corporations and make decisions to buy or sell their stocks before you and me.

Professional floor traders of the largest commercial banks like JP Morgan are also aware of Nvidia’s next stellar earnings report. While you’re reading its press release after market close, the floor traders and High Frequency Traders are already in a position. You’re the last one to buy.

This goes beyond stocks.

The oil price began to soar several weeks before Russia’s special military operation in Ukraine.

The oil price also began to grow two days before the recent conflict between Israel and Iran.

Someone knew what was coming and made money on that.

You can look at the charts but without context it’s hard to figure out the reason for the price dynamics. The retail news is always late for good trading decisions.

Unless you’re an insider, you’re gambling. You could be lucky a few times. But no trading system allows you to make consistent profits by trading on your phone.

So don’t day trade. Be a long-term investor.

The bottom line

Day trading should be banned if you’ve never learned it from professionals. You have no instruments or strategy to outsmart millions of other traders.

It’s not a bad thing. Trading elevates your risk. You may reduce it by being a long-term investor.

Time in the market beats timing the market. Stay invested for the long term to profit from compound interest.

That’s how you make the most money.

This article is for informational purposes only. It should not be considered Financial or Legal Advice. Not all information will be accurate. Consult a financial professional before making any major financial decisions.

P. S. If I convinced you to be a long-term investor, hit the Subscribe button. I’ll give you concrete ideas for long-term investing.

I was an institutional trader for most of my career, and completely agree with your piece. My teams serviced long-short hedge funds that couldn’t even compete on a swing-trading strategy vs the Quants. An individual can definitely make short term profits day trading, but generally see all their incremental gains wiped out on the big moves.

Well, you can't say that DT is universally bad (e.g. https://finance.yahoo.com/news/nashville-man-22-makes-90k-120300863.html), - it's just the majority who doesn't make anything from it.