BlackRock’s Recent Investments in Tech Challenge the Popular Recession Thesis

Smart money is flowing into services-oriented companies

If investing based on financial news feeds was the right move, we’d all be millionaires, and CNBC would charge a six-figure annual subscription fee.

I’m against making financial decisions on emotions. You should use data instead.

But in the Internet age, the loudest headlines grab the most attention no matter how much sense they make. The word “Recession” draws extra clicks.

So if you want to skew the data/emotion ratio in your favor, switch off the news. And follow investors who have the most money.

BlackRock manages $11,5 trillion for the American middle class. It’s the largest asset management company in the world. It knows better than anyone where the economy is headed.

Here’s what it’s investing in right now.

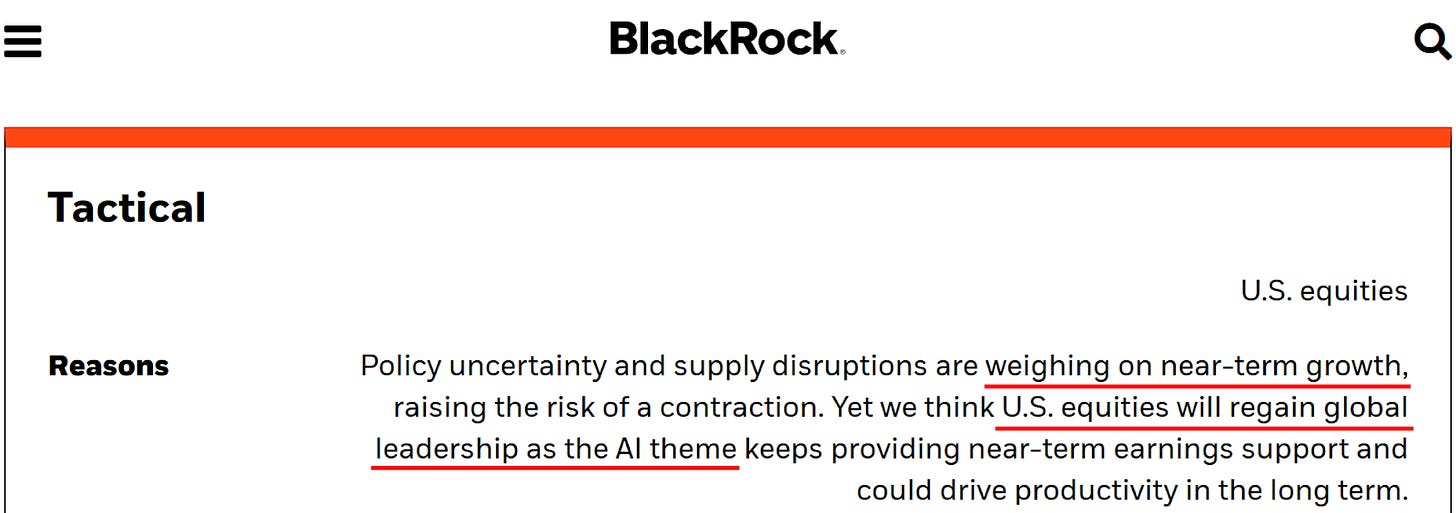

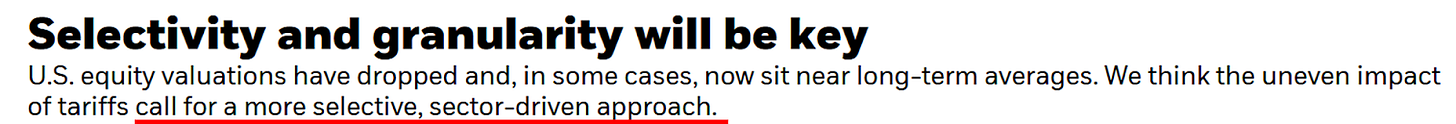

Invest for the long term but be selective

The recent tariff situation challenged the stock market.

Now that you look back three months, it was just a data point. Panic sellers lost, long-term investors added to their portfolios. The market is back to the previous all-time highs.

BlackRock insinuates you shouldn’t confuse short-term volatility with long-term growth. Invest for the long haul.

This aligns with what drives bull markets: New technologies. And the key disruptive technology in 2025 is AI.

We’re only getting started with AI. Even if it replaces a few jobs, new jobs will emerge, and our productivity will skyrocket. The companies that integrate AI into their operations will be long-term winners.

That doesn’t mean every one of the 5,000+ public companies listed on the US stock exchanges will profit from the boom.

A sad example is Chegg ($CHGG), an online education platform. It became overvalued during the Covid pandemic and was losing its valuation.

And when it became clear ChatGPT could do for free what Chegg charged fees for, its stock nosedived even more. It’s still 99% down from its all-time high.

You need to be selective in your investing decisions. BlackRock drives this point home.

The tariff situation could help you narrow down your focus. The companies least affected are service-oriented, whereas businesses that import stuff could take a blow.

This is clear given the transition of the US economy from manufacturing-based to service-based to digital.

How the US is transitioning to a digital economy

The US relied on manufacturing after WWII. The key industries were steel, automotive, and textile.

Nowadays manufacturing employs 8,3% of the workforce and contributes 10% to the GDP. This is due to offshoring and automation. The demand for labor-intensive production is just not there any longer.

Services like healthcare and finance began driving the US economy in the 1980s. By 1990, they accounted for 70% of the US GDP.

Services still dominate (currently at 80%) but a shift to digitization is happening. E-commerce, chatbots, and automated warehouses replace the need to employ humans.

These assets are driving economic growth:

AI

Data

Cloud

Software

Online platforms

Some individuals call this a digital bubble. Well, it’s not bursting any time soon. A digital economy is more efficient, and it’s driving more growth.

You can see that in BlackRock’s recent buys and sells.

What BlackRock is buying (one niche is in focus)

BlackRock holds 5,215 stocks.

We’re interested in companies that use AI and drive revenue from digital services. Two industries come into question:

Software - Application (278 stocks): Software-as-a-Service and productivity tools

Software - Infrastructure (150 stocks): Cloud and data management software

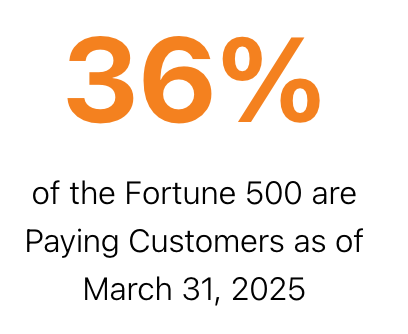

I won’t bore you with information on every company. Here are a few stocks from Software - Application using AI that BlackRock is adding to (despite already being among the top holders).

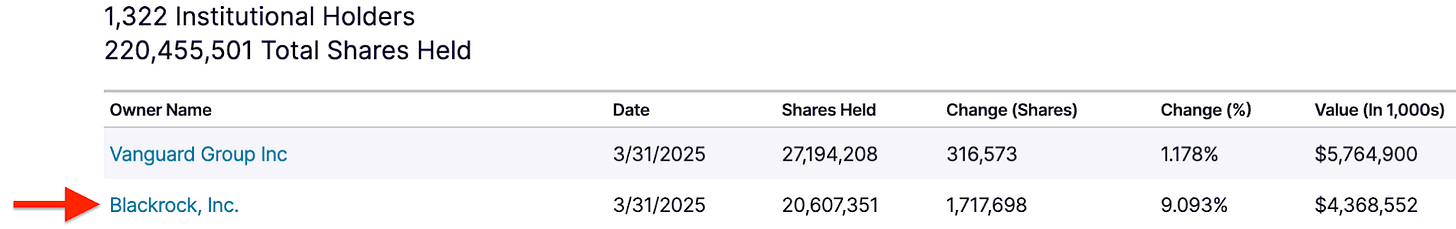

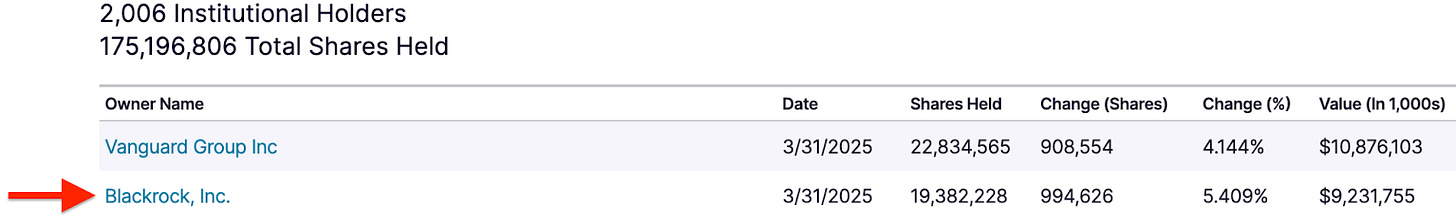

1. Alkami Technology ($ALKT): A cloud-based platform for digital banking solutions.

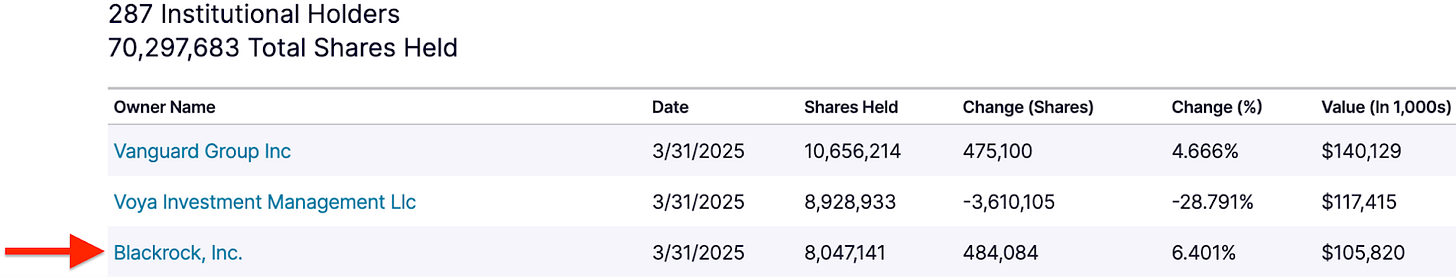

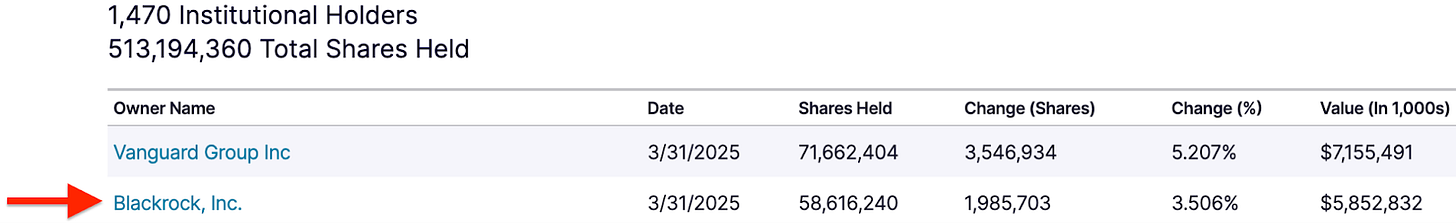

2. Snowflake ($SNOW): A platform that provides cloud-based data storage and AI-driven analytics for businesses.

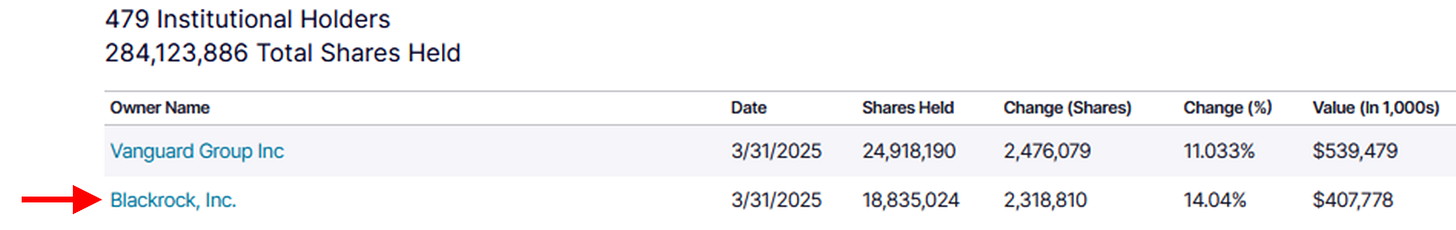

3. Asana ($ASAN): A platform that delivers AI-enhanced collaboration and productivity tools for teams.

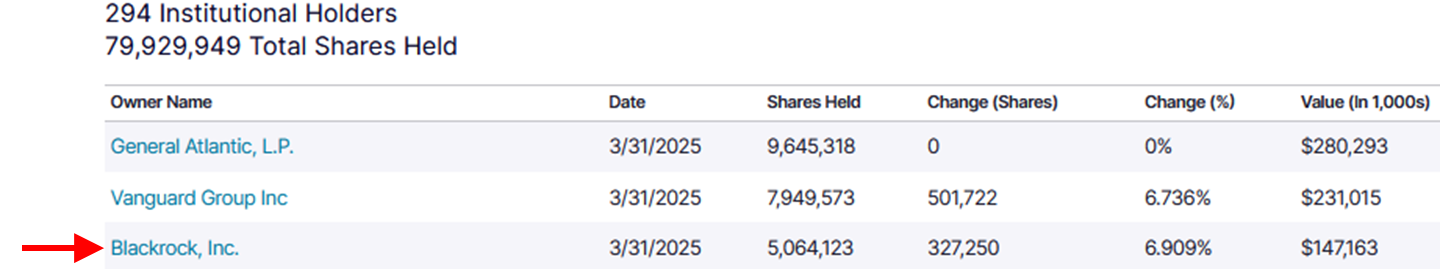

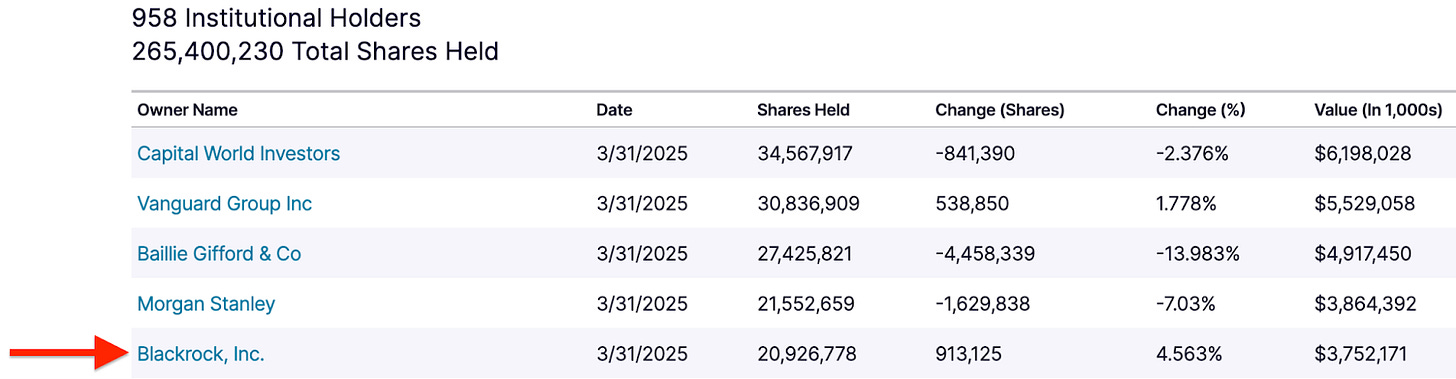

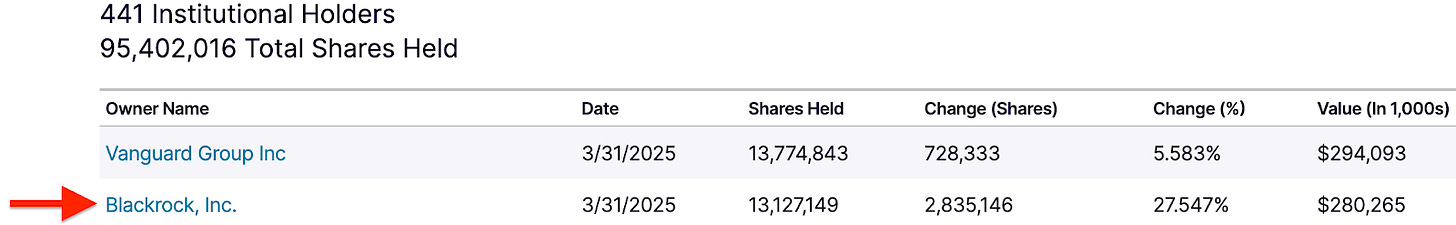

4. Clearwater Analytics ($CWAN): A cloud-based platform that automates investment accounting, data reconciliation, and reporting for institutional investors.

BlackRock’s buys from Software - Infrastructure:

1. Cloudflare ($NET): A platform that enhances website performance and security.

2. CrowdStrike ($CRWD): A platform that provides endpoint protection for laptops, servers, and mobile devices connected to networks.

3. Fortinet ($FTNT): A platform that delivers security control via networking (connecting users to apps) and security (protecting data)

4. Teradata Corporation ($TDC): Cloud-based data analytics and management software that helps businesses gain insights from large data sets.

The percentages of shares added aren’t high for every stock. It’s because BlackRock has been accumulating them slowly over several quarters.

The additions by March 31, 2025 reflect BlackRock’s confidence in the continuing growth stories of these companies.

I can’t help but mention the stocks from Software - Infrastructure. $NET, $CRWD, and $FTNT are cybersecurity companies. It’s not a separate industry yet. But it reflects the main concern of US businesses in 2025.

Cyber attacks are on the rise. They could be a problem for the digital economy. Stealing the digital assets of individual companies could lead them to lose money or become less competitive (and eventually lose money).

I see a recession if several digital industries get harmed through cyber attacks. It’s not likely but not impossible.

Cloudflare’s main page shows that the largest corporations take cyber threats seriously.

Large financial institutions like BlackRock are supporting the stocks of individual companies in cybersecurity. Preventing cyberattacks while hackers invent new methods is an ongoing battle.

So far the digital economy is growing, which means the good guys are winning.

So don’t expect a recession. The stocks that BlackRock is investing in are a good starting point to understand where the economy is going and how you can profit from it.

Final thoughts

Following the largest asset management companies helps you make good financial decisions.

In 2025, BlackRock and other large investors are loading up on service-oriented companies. Their cybersecurity services stand out.

Naturally, there are growing stocks in other industries.

But given the geopolitical climate, trade wars, and shift of the American economy to digital, the above stocks will be long-term winners.

This article is for informational purposes only. It should not be considered Financial or Legal Advice. Not all information will be accurate. Consult a financial professional before making any major financial decisions.

P. S. I post this newsletter twice a week to help people make solid investing decisions. If you want to learn what large investors like BlackRock are doing with their trillions of dollars, hit the Subscribe button.

We were never going into a recession…