Hey friend,

Index funds are overrated.

I have data. Out of the six financially independent people I know only one has retired on index funds. It’s not impossible but it’s hard.

The problem is you’ll have to sell your index funds to cover your living expenses. You have no idea how much they’ll be worth.

If you happen to retire in a full-blown recession, you’ll have to wait for them to come back.

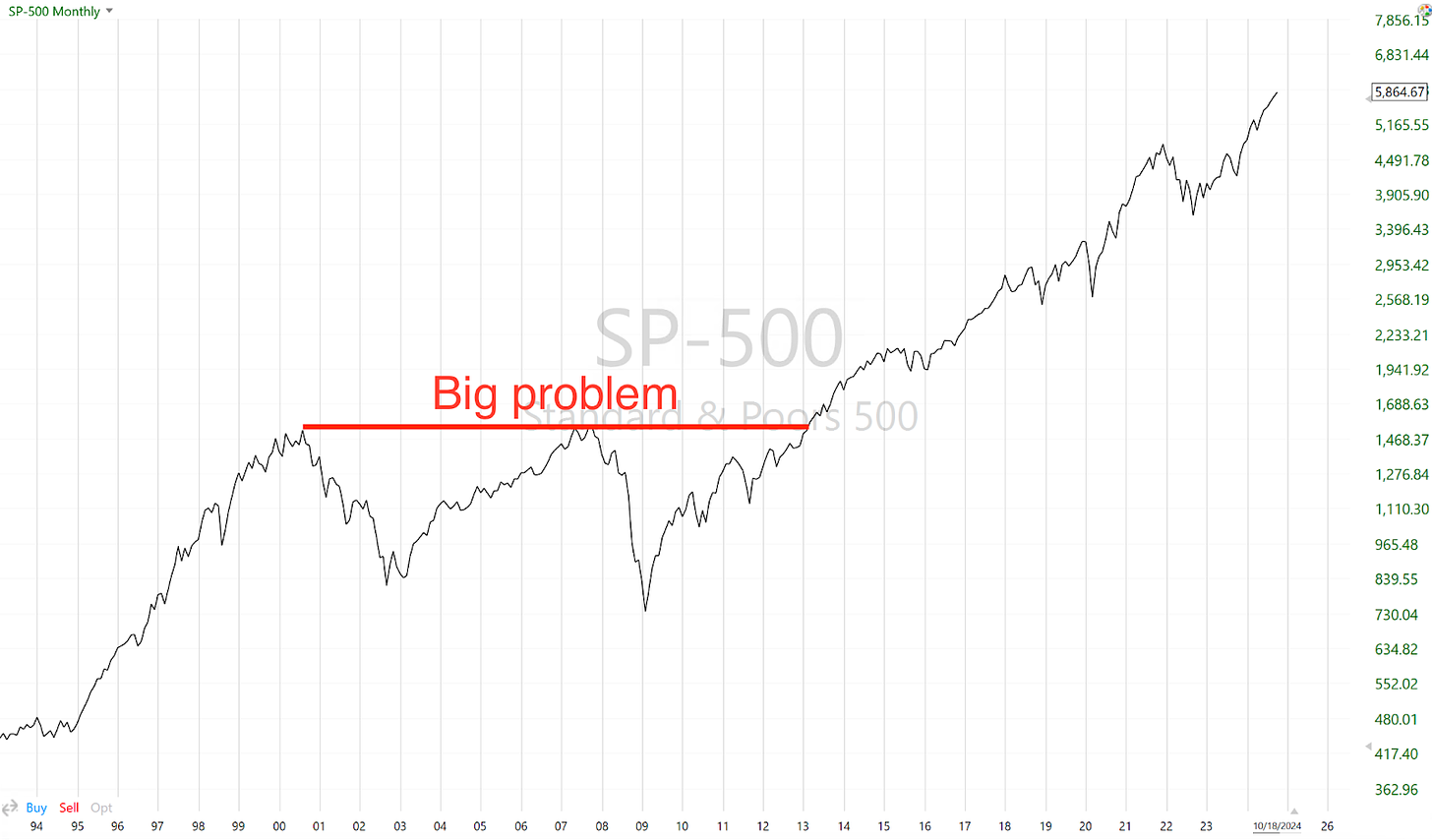

Possibly longer than a decade.

It took the S&P 500 thirteen years to hit its previous 2000 all-time high.

Don’t run this risk.

Learn what real retirees do. Focus on your cash flow instead like my other five financially free friends.

Dividend ETFs will help you hit your freedom number. The underlying dividend-paying companies are

Household names

Reluctant to cut the dividends

Not failing from one day to the next

Less volatile than the rest of the market

And here’s the bombshell.

You’ll never have to sell your dividend ETFs.

They pay you for holding them. Their price is unimportant. It’s your peace of mind.

I’m speaking from experience. My dividend ETFs make me indifferent to asset prices in the stock market.

Election or no election, war or no war, recession or no recession, I keep getting paid. It’s the classic example of using your money to make more money.

I already have peace of mind at 37. My dividend income keeps growing. There’s even more peace to come by the time I retire.

Dividend ETFs are the ultimate solution for your retirement.

The paid version of Stay Invested will help you find dividend ETFs aligned with your risk tolerance.

You’ll build a retirement fund you’ll never have to sell.

You’ll get paid once a month (or once a quarter), no matter what happens in the world.

You’ll spend your golden years without financial worries.

If you subscribe now for $50/year, I’ll be delighted to meet you on a Zoom call and develop a plan that meets your retirement goals.

Start planning your retirement now so time helps you maximize your dividend income. I’m here to help.

P. S. I’ll hike the price after the launch in 18 days.

It makes sense to focus on generating a post-retirement income for oneself. This can occur through dividends, capital gains, or a combination. If one saves a sufficient amount, then they can create a large enough income stream from the income generated by the portfolio. The nice thing about being able to live off dividends is that one becomes indifferent (relatively speaking) to the underlying price of the stock.